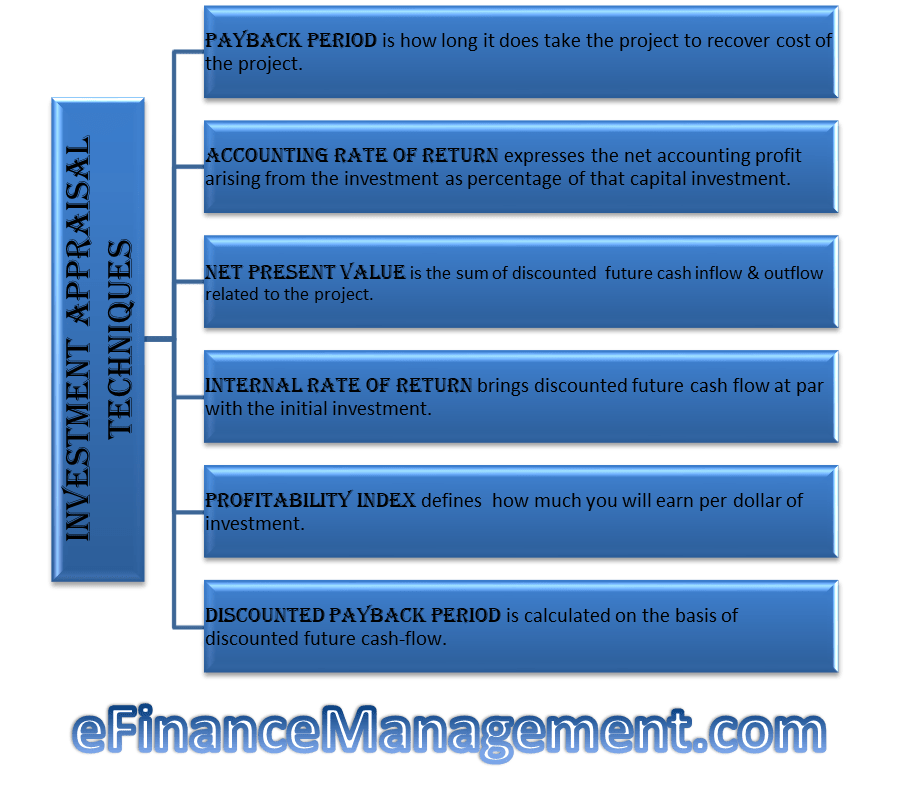

Managerial Economics. Profitability index defines how much you will earn per dollar of investment. It’s normally calculated as the average annual profit you expect over the life of an investment project, compared with the average amount of capital invested. Running this blog since and trying to explain «Financial Management Concepts in Layman’s Terms». Real options analysis tries to value the choices — the option value — that the managers will have in the future and adds these values to the NPV.

You are here

Jump to navigation. To do this, click. All businesses require capital equipment fixed assets such as machinery, premises and vehicles. The purchase of such assets is known as capital investment and is undertaken for the following reasons:. Invext investment, like all other business activities, involves an element of uncertainty, because expenditure is incurred today in order to produce some benefit in the future.

The benefits of investing in your business

Appraisal value — The appraisal value is the value of a company based on a projection of future cashflows that its owners will receive from the company s assets as well as from its current and future operations. Appraisal Ratio — A ratio used to measure the quality of a fund s investment picking ability. It compares the fund s alpha or the adjusted return of the fund assuming the market return is zero to the portfolio s unsystematic risk or residual standard deviation. Real estate appraisal — Real estate appraisal, property valuation or land valuation is the practice of developing an opinion of the value of real property, usually its Market Value. Member of the Appraisal Institute — MAI is a professional designation for real estate appraisers who are experienced in the valuation and evaluation of commercial, industrial, residential, and other types of properties, and who advise clients on real estate investment decisions.

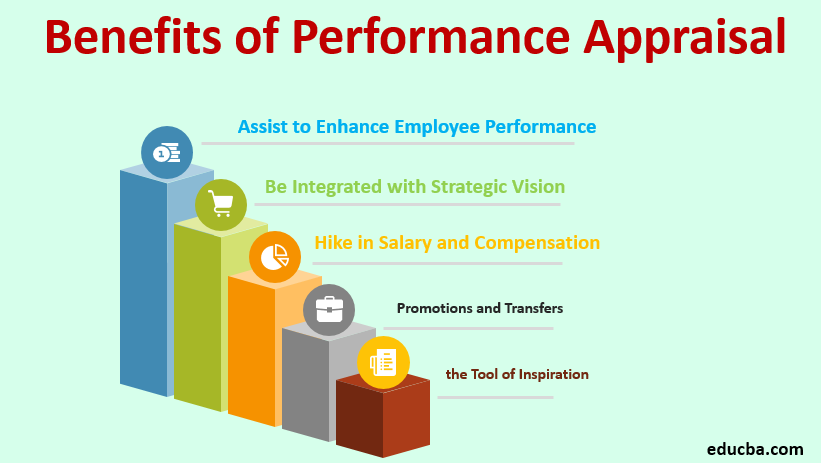

Please don’t provide invest appraisal system personal information. One of the simplest investment appraisal techniques is the payback period. It is also known as return on investment or return on capital. Most organizations have many projects that could potentially be financially rewarding. In such a case, if the IRR is greater than the cost of capital, the NPV is positive, so for non-mutually exclusive projects in an unconstrained environment, applying this criterion will result in the same decision as the NPV method. Note: Your feedback will help us make improvements on this site. Main article: Equivalent annual cost. Investment Appraisal Techniques. Payback period is a simple technique for assessing an investment by the length of time it would take to repay it. Save my name, email, and website in this browser for the next time I comment. Accept cookies Cookie settings. Then the profitability index is 1. The discounted cash flow methods essentially value projects as if they were risky bonds, with the promised cash flows known. Maheshwari Despite a strong academic preference for maximizing the value of the firm according to NPV, surveys indicate that executives prefer to maximize returns [ citation needed ]. Was this helpful? There are two options Machine A and Machine B.

Comments

Post a Comment