Contribute regularly and at appropriate levels. Essentially, you should take more risks while you are young with a heavier weighting in stocks, and slowly dial down risk with a higher weighting in bonds as you get older. Very few people max out from day one.

Hint: You don’t need a high-paying job or family money

That said, those with seven-figure portfolios do have a few things in common, she notes. Here are three habits and strategies that have worked for them and could work for you. Time is on your side when you’re young. The sooner you start putting your money to work, the less you’ll have to save each month to reach your goals, thanks to the power of compound. No matter what else is going on in their financial life, they’re making it a priority to save for the future. If your company offers a k plan, they may also offer a k matchwhich is essentially free money, how much to invest to get 401k millionaire it’s up to you to take advantage of it.

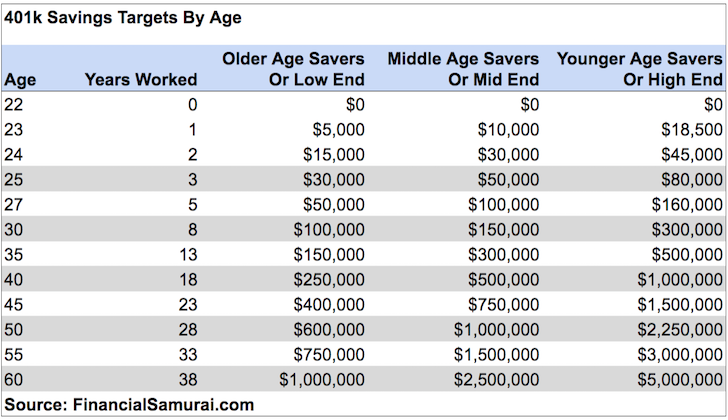

The Median and Average 401(k) By Age In America

Wondering how to become a millionaire? It may sound impossible to some people, but it doesn’t have to be an out-of-reach pipe dream. With careful planning, patience, and smart savings, it’s possible to make a million dollars. You don’t need a six-figure job or family money to become a millionaire. Instead, you need to start saving early and be mindful of every dollar you spend.

Ways To Become A 401(k) Millionaire

When you first become eligible to contribute to a k plan, contribute as much as you. If your employer offers a match, contribute enough to earn the full match. Not doing so is leaving free money on the table. The key is to start early. Select your k account investments based on your financial objectives, age, and risk tolerance. The general millionaire is that the longer you millionairre until retirement, the more risk you millionaide.

The most important thing is miillionaire keep tracking this money. As you move on in your career and have more employers, it can be difficult to remember where all your assets are.

Whichever choice you make now, you may want to consolidate them with other retirement accounts, later on, to make your funds easier to manage. Because target-date funds provide you with a diversified portfolio, they how much to invest to get 401k millionaire be a good option for younger investors, who may not have other investments outside of their k plan.

One of the big selling points touted by target-date fund issuers is the glide path. And also watch the fees: Some target-date funds cost more than other good retirement options, such as index funds and ETF funds. Hiring a financial advisor to help you look at your current k plan in the context of these other investments can help you get the most out of your k.

The quality of this advice varies, so do your homework ahead of time. Taking action early and continuously during your working life is key to maximizing the value of your k account and becoming a k millionaire. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters.

Retirement Planning K. Key Takeaways Begin contributing to a k plan as early as you. Contribute regularly and at appropriate levels. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links. Related Terms What is a k Plan? A k plan is a tax-advantaged, defined-contribution retirement account, named for a section of millionaide Internal Revenue Code. Learn how they work, including when you need to change jobs.

Retirement Planning Retirement planning is the process of determining retirement income goals, risk tolerance, and the actions and decisions necessary to achieve those goals. Pay-As-You-Go Pension Plan Definition A pay-as-you-go pension plan is a retirement arrangement where the plan beneficiaries decide how much they want to contribute. Pension Plan A pension plan is a retirement plan that requires an employer to make contributions into a pool of funds set aside for a worker’s future benefit.

Personal Finance Personal finance is all about managing your income and your expenses, and saving and investing. Learn which educational resources can guide your planning and the personal characteristics that will help you make the best money-management decisions.

It’s not as daunting as it seems

The current retirement system leaves much to be desired. Because target-date funds provide you with a diversified portfolio, they can be a good option for younger investors, who may not have other investments outside of their k plan. Personal Finance. The fact that more people change jobs these days adds another degree of difficulty as. The key is to start early. Essentially, you should take more risks while you are young with a heavier weighting in stocks, and slowly dial down risk with a higher weighting in bonds as you get older. Sign Up Log In. Given the sobering average and median k balances in How much to invest to get 401k millionaire, we can conclude that becoming a k millionaire is quite a feat.

Comments

Post a Comment