Much of this economic commingling began in the s, when Hong Kong companies began relocating production centers to the mainland—especially to Guangdong province. China has also become a major investor in Hong Kong. Related Articles. While the law and the business ethics are clear, in many cases, the penalty fines remain much less onerous than losing critical long-term business revenues. All Regions. How Governments Discourage or Restrict FDI In most instances, governments seek to limit or control foreign direct investment to protect local industries and key resources oil, minerals, etc.

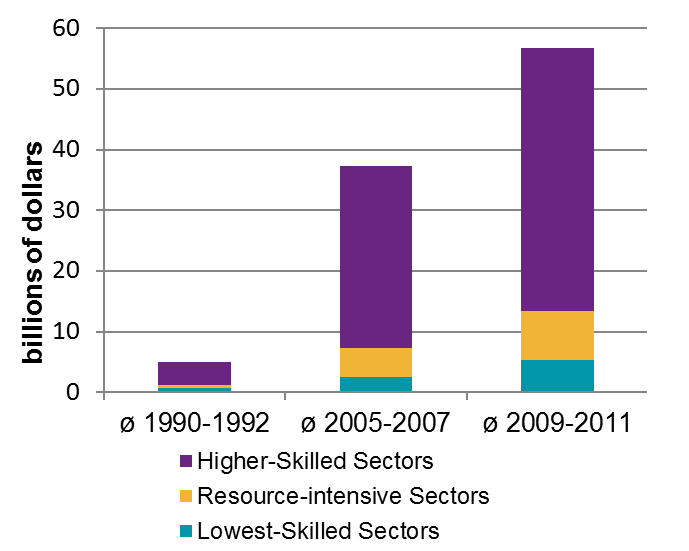

Foreign direct investment in Iran FDI has been hindered by unfavorable or complex operating requirements and by international sanctionsalthough in the early s the Iranian government liberalized investment regulations. Iran ranks 62nd in the World Economic Forum ‘s analysis of the global competitiveness governnent countries. Foreign investors have concentrated their activity in a few sectors of the economy: the oil and gas foreign direct investment government contracts, vehicle manufacture, copper miningpetrochemicalsfoods, and pharmaceuticals. Firms from over 50 countries have fkreign in Iran in the past 16 years —with Asia and Europe receiving the largest share, as follows: [10]. Dorect ofAsian entrepreneurs made the largest investments in the Islamic state by investing in 40 out of 80 projects funded by foreigners.

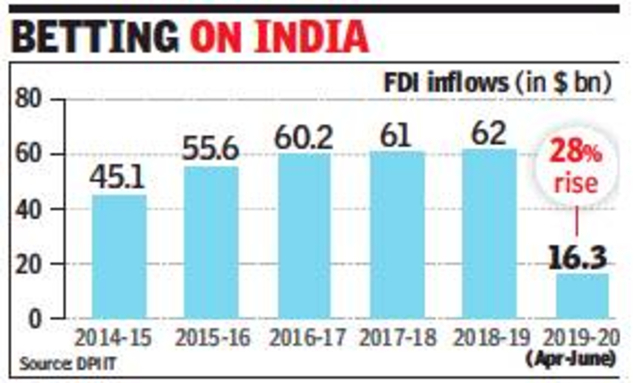

Economy losing shine

A foreign direct investment FDI is an investment made by a firm or individual in one country into business interests located in another country. Generally, FDI takes place when an investor establishes foreign business operations or acquires foreign business assets in a foreign company. However, FDIs are distinguished from portfolio investments in which an investor merely purchases equities of foreign-based companies. Foreign direct investments are commonly made in open economies that offer a skilled workforce and above-average growth prospects for the investor, as opposed to tightly regulated economies. Foreign direct investment frequently involves more than just a capital investment.

Hong Kong. These policies created disincentives for many global companies. Financial incentives. Are there local incentives cash and noncash for investing in one country versus another? Natural resources. Host governments improve or enhance local infrastructure—in energy, transportation, and communications—to encourage specific industries to invest. The major changes brought in by the Rules and the Debt Regulations have been discussed. FDI is primarily a long-term strategy. Typically, investors in this category are looking for a financial rate of return as well as diversifying investment risk through multiple markets. A brownfield FDI An FDI strategy in which a company or government entity purchases or leases existing production facilities to launch a new production activity. The DICA is the voreign vehicle for remittance offshore of profits, other lawful incomes and capital foreign direct investment government contracts case of reduction of foreign direct investment government contracts capital, transfer of the project, or termination of the projectas well as repayment of foreign loans, interest contractss borrowing expenses. Governments seek to promote FDI when they are eager to expand their domestic economy and attract new technologies, business know-how, and capital to their country.

Comments

Post a Comment