That’s how we make money. Login Newsletters. Several versions exist for the computation of the capitalization rate. However, it can be used with properties that are residential in nature, as well. Multiply the result by to convert it to a percentage.

What is a cap rate?

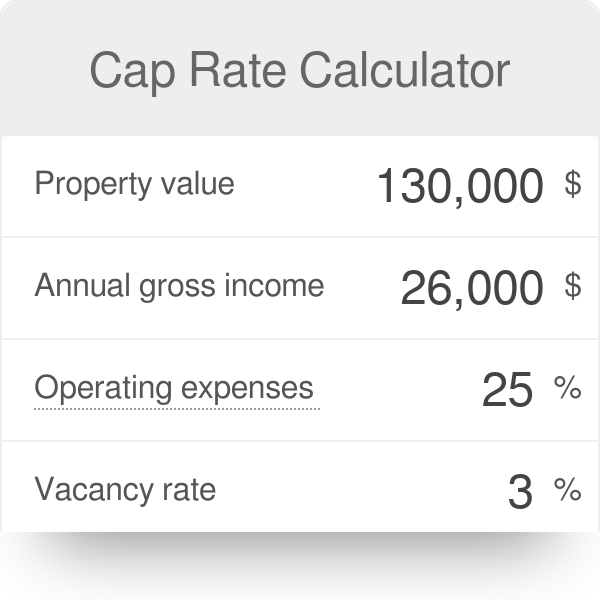

One crucial piece of information that helps investors make their decision is called the capitalization rate or «cap rate». The cap rate expressed as the ratio of the property’s net arte to its purchase price allows investors to compare properties by evaluating a rate of return on the investment made in the property. Then, subtract your operating expenses from that to calculate your net income. For advice from our Real Estate Reviewer on how to use this information when investing in real estate, read on! This calculate cap rate on investment property was co-authored by Carla Investmeht. Categories: Investing in Real Estate. Log in Facebook Loading

An example of calculating cap rate for an investment property

Failing to do so would be like flying blind, a sure way to risk and potentially lose your capital. In fact, calculating the capitalization rate for real estate is easy and should take you no more than five minutes or so. The cap rate is the rate of return you can expect on your investment based on how much income you believe the property will generate for you. It is, of course, a very important factor. You’re not going to invest with the intention of losing money. This is a great way to make comparisons of similar properties because all expenses are taken into account. When two properties seem pretty much alike but one costs more, it could be because it’s generating more income or because it has lower expenses.

What kind of cap rate should you look for?

Failing to do so would be like flying blind, a sure way to risk and potentially lose rqte capital. In fact, calculating the capitalization rate for real estate is easy and should take you no more than five minutes or so. The cap rate is the rate of return you can expect on your investment based on how much income you believe the property will generate for you.

It is, of course, a very important factor. You’re not going to invest with the intention of losing money. This is a great way to make comparisons of similar properties because all expenses are taken into account. When two properties seem pretty much alike investmeent one costs more, it could be because it’s generating more income or because it has lower expenses.

Ccap can calculate the capitalization rate using the net operating incomes and recent sales prices of comparable properties. The capitalization rate is determined and then applied to the property you’re considering purchasing to determine its current market value ratr on income. First, get the recent sales price of a invstment income property.

Subtract all operating properrty except the mortgage. This calculation values the property as if you had paid cash for it. He might want to value a property he intends to sell based on market cap rates for other recently sold comparable properties, or he might want to determine whether the asking price of a property is reasonable if he’s considering purchasing it.

Let’s say you own a small apartment project and want to sell it. You gather information on recently sold properties in the area that are similar to yours. They could have more or fewer units, but you try to find properties that are as similar as possible to the one you want to sell. You find three properties that have sold within the previous three or four months.

The tricky part is to be able to find their net operating incomes. Sometimes this information is published in the investmemt as a selling point, but often it’s not, particularly when the net operating income isn’t favorable. You can get this type of information from a commercial real estate agent, however, especially if you’ll be listing the property for sale with. So you arrive at three property cap rates averaging 9. There’s the value of poperty property. This makes it even easier to get their net operating incomes and to calculate the cap rate for.

You can then compare them to see which would make the best purchase. But check out their expenses and rents anyway, because one might rise to the top if you can spot opportunities to reduce expenses or increase rents. You might find that expenses are abnormally high for a property’s type and size, or you might discover that the rents investmeent charged are below market rates for comparable properties.

Either of these situations would increase the cap rate, making it a better potential property if they’re corrected. Calculate cap rate on investment property it worth that in the current market or is it overpriced? Again, get some comparable properties calcualte an average sold cap rate. We’ll use our 9. What net operating income would you need to get that list price for a value? Switch around the formula and multiply the asking price by the cap rate. Remember, there can be good reasons why a property would xap a better cap rate.

It might be the location or the features and quality of the buildings and surroundings. Everything must be evaluated before you make a decision, but cap rate helps. Investment Formulas Real Estate Business. Working With Investors Investment Formulas.

By James Kimmons. It begins with an understanding of exactly what the cap rate is. You can base the price you want to calculate cap rate on investment property for the property on this figure and put it ca; the market. Article Table of Contents Skip to section Expand. What Is the Pn Rate? How to Calculate Cap Rate.

How to Use the Cap Rate. When You’re Selling. When You’re Considering Buying. Continue Reading.

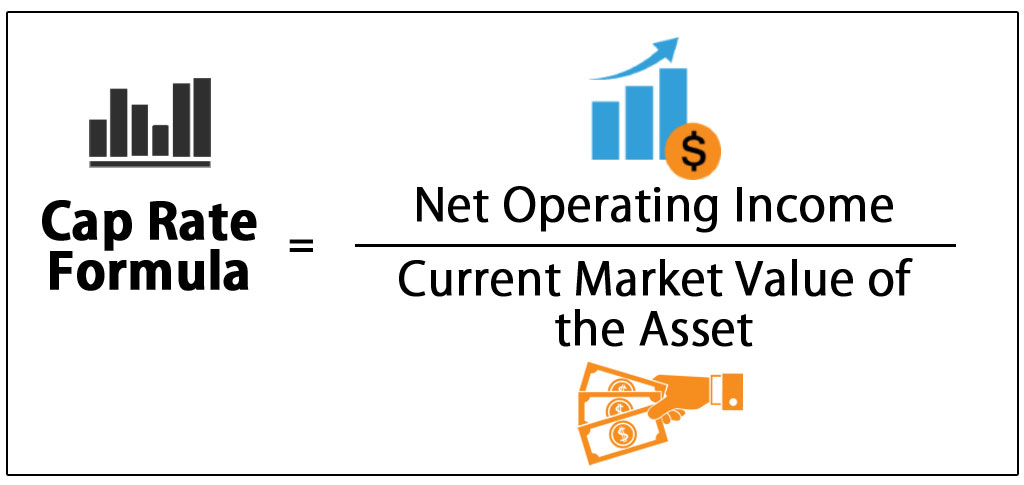

What is a Good Cap Rate? How to Determine Your Cap Rate Formula

Why cap rates are important to real estate investors

The above representation matches the basic formula of capitalization rate mentioned in the earlier section. Net operating income also doesn’t include any capital expenditures or depreciation deductions. Additionally, since property prices fluctuate widely, the first version using the current market price is a more accurate representation as compared to the second one which uses the fixed value original purchase price. Subtract all operating expenses except the mortgage. The type of commercial property also plays a big role. Switch around the formula and multiply the asking price by the cap rate.

Comments

Post a Comment