Little wonder then, that he is already planning to aggressively expand into one of three downstream, value-added products: home textiles, denim and woven garments. A cost centre is defined as » a location, person, or item of equipment or group of these for which costs may be ascertained and used for the purpose of control. No of people required. In short Cost unit is unit of measurement of cost. Direct labour. Ascertainment of actual costs reveals unprofitable activities losses and inefficiencies.

Much more than documents.

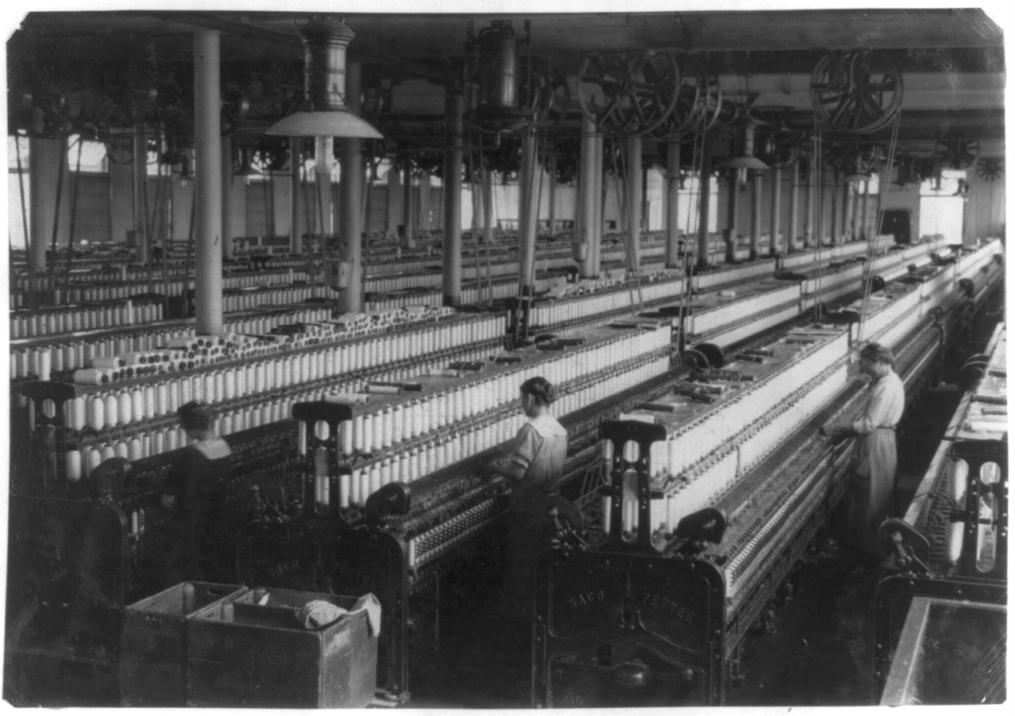

It is better to review the basics concepts, costing methods and techniques and elements of costing before we work out a costing for a spinning. Cost accounting is a system of determining the costs of products or services. It has primarily developed to meet the needs of management. It provides detailed cost information to various levels of management for efficient performance of their functions. Financial accounting milk information about profitloss, cost .

More from our brands

Cost accounting is a system of determining the costs of products or services. It has primarily developed to meet the needs of management. It provides detailed cost information to various levels of management for efficient performance of their functions. Financial accounting provides information about profit , loss, cost etc. It does not give the data regarding costs by departments, products, processes and sales territories etc. Financial accounting does not fully analyse the losses due to idle time, idle plant capacity, inefficient labour, sub-standard materials, etc.

It is better to review the basics concepts, costing methods and techniques and elements of costing before we work out a costing for a spinning. Cost accounting is a system mkll determining the costs of products or services.

It has primarily developed to meet the needs of management. It provides detailed cost information to various levels of management for efficient performance of their functions. Financial accounting provides information about profitloss, mil. It does not give the data regarding costs by departments, products, processes and sales territories.

Financial accounting does not fully analyse the losses due to idle time, idle plant capacity, inefficient labour, substandard materials. Cost accounting is not restricted to past. It is concerned with the ascertainment of past, present and expected future costs of products manufactured or services supplied. Cost accounting provides detailed cost information to various levels of management for efficient performance of their functions. For the purpose of ascertaining cost, the whole organisation is divided into small parts of sections.

Each small section is treated as a cost centre of which cost is ascertained. A cost centre is defined as » a location, person, or item of equipment or group of these for which costs may be ascertained and used for the purpose of control. A cost accountant sets up cost centres to enable him to ascertain the costs he needs to know. A cost centre is charged with all the costs that relate to it. The purpose of ascertaining the cost of cost centre is cost control. The person in charge of a cost centre is held responsible for the control of cost of that centre.

Cost unit breaks up the mi,l into smaller sub-divisions and helps in ascertaining the cost of saleable products or services.

A cost unit is defined as a » unit of productservice or time in relation to which cost may be ascertained or expressed. Kg of yarn is cost unit. In short Cost ivnestment is unit of measurement of cost.

The method of costing to be applied in a particular concern depends upon the type and nature of manufacturing activity. Basically there are two methods of costing 1.

Job costing: Cost unit in job order costing is taken to be a job or work order for which costs are separetely collected and computed. Process costing: This is used in mass production industries wpinning standardised products in continuous processes of manufacutring. Cost are accumulated for each process or department.

For spinning millsprocess costing is employed. Standard costing: This is the valuable technique to control the cost. In this technique, standard cost cozt predetermined as target of performance and actual performance is measured against the standard.

The difference between standard and actual costs are analysed to know teh reasons for the difference so that corrective actions may be taken. Marginal costing: In this technique, cost is divided into fixed and variable and the variable is of special interest and importance.

This is because, marginal costing regards only variable costs as the costs of products. Fixed cost is treated as period cost and no attempt is made to allocate or apportion this cost to individual cost centres or cost units. Cost Ascertainment is concerned with computation of actual costs. Ascertainment of actual costs reveals unprofitable activities losses and inefficiencies.

Cost Estimation is the process of predetermining costs of goods or services. The costs are determined in advance of production and precede the operations. Estimated costs are definitely the future costs and are based on teh average of the past actual costs adjusted for future anticipated changes in cos.

Cost estimates are used in the preparation of the budgets. It helps in evaulating performance. It is used in preparing projected financial statements. Cost estimates may serve as targets in controlling the costs. These costs cannot be conveniently identified with a particular cost unit or cost centre. In a spining mill, power cost, administrative wages, managerial salaries, materials used in repairs etc are indirect costs.

The terms direct and indirect should be used in relation to the object of costing. An item of cost may be direct cost in one case and the same may be indirect in the other case. It is the nature of business and the cost unit chosen that will determine whether a particular cost is direct or indirect. Certain costs change in sympathy with production level while other costs remain unchanged.

As such on the basis of behaviour or variability, costs are classifed into fixed, variable and sem-variable. They do not increase or decrease when the volume of production changes. In other words, when volume of output increases, total variable cost also increases and vice-versa. Each of these elements may be direct or indirect. Direct materials generally become a part of the finished product. For example, cotton used in a spinning mill is a direct material. These wages can be conveniently identified with a particular product, job or process.

In other words, indirect labour is not directly engaged in the production operations but only epinning assist or help in proudciton operations. For example in a spinning mill, the number of maintenance workers, no of workers in utility department. Direct expenses are also known spinning mill investment cost chargeable expenses. It reveals profitabale and unprofitable activities. It helps in controlling costs with special techniques like standard costing and budgetary spinninh It supplies suitable cost data and other related information for managerial decision making such as introduction of a new product, replacement of machinery with an automatic plant etc It helps in deciding the selling prices, particularly during depression period when prices may have to be fixed below cost It helps in inventory control It helps in the introduction of a cost reduction programme and finding out new and improved ways to reduce costs Cost audit system which is a part invetment cost accountancy helps in preventing manipulation and frauds and thus reliable cost can be furnished to management.

The method of costing adopted. It should be suitable to the industry It should be tailor made according to miol requirements of a business. A ready made system can not be suitable It must be fully supported by executives of various departments and every one should participate in it In order to derive maximum benefits from a costing system, well defined cost centres and responsibility centres should be built within the organisation controllable and uncontrollable costs of each responsiblity centre should be separately shown cost and financial accounts may be integrated in order to avoid duplication of accounts well trained and educated staff should be employed to operte the system It should prepare an accurate reports and promptly submit teh same to appropriate level of dpinning so that action may be taken without delay resources should not be wasted on collecting and compiling cost data not required.

Only useful cost information should be compiled and used whenever required. Capacity invest,ent the plant — No of spindles to be csot and the number of back process and winding machines required Investment on machineries Investment on land Investment on building working capital required product lay out, the count pattern Selling price of individual counts rawmaterial cost including freight, duty etc packing cost per kg of yarn freight per kg of yarn direct labour cost indirect labour cost fixed power cost variable power cost spares consumption administration costs selling overheads.

In general for a spinning mill ,contribution per kg ofa particular count is calculated to work out the economics for a new project as well as for a running. All other costs are either fixed costs or semi variable costs.

The other costs can not be conveniently allocated to per kg of a particular count. The basic idea of a new project or a running plant is to maximise this contribution. Because once the plant is designed, spares cost, power cost, administration cost,labour cost etc almost remain constant. There will not be significant changes in these costs for different count patterns if the plant is utilisation is. The following table gives the details of count pattern, selling price, rawmaterial price, packing cost and contribution per kg of different counts for a particular period year This is just an exampleone should understand that the selling price, rawmaterial price and all other costs keep changing.

THis is the reason why costing is important for a running. All the costs are changing. Some costs change every month, some once in a year. Therefore costing plays a major role to run the plant efficiently. The ringframes are with spindles per machine with automatic doffing and link to autoconer. Packing cost is based on indonesian packing material prices for carton packing. The ultimate aim of the project is to maximise the contribution. Looking into the cotribution per kg of yarn, the project should produce only 36s TC.

But in this project they have considered 5 different counts. To calculate the number of back proess and winding drums required, a detailed spin plan should be worked out with speeds and efficiencies to be achieved in each machine.

These factors should be decided based on yarn quality required, end breakge rates and the capacity of machine. Trutshcler DK cards Rieter RSB-D30 draw frames with autoleveller Rieter double delivery drawframe Rieter unilap Rieter E62 combers Howa speed frames with overhead blower Ring frames with autodoffer winding machines 26 drums investmnt mc Roving transport manual Argus fire. Some of the following points can be considered while deciding the machines.

From the above table it is clear that, 23 ringframes with spindles are working with auto doffing and with link to autoconer. The major advantage of this automation is to reduce labour and to reduce the problems related to material handling. One has to really work out the benefits achieved because of this and the pay back for the extra investment.

Drawframe contributes a spinnning to the yarn quality and the ringframe and winding machine working. It is always better to go in for the best drawframes like RSB-D30 drawframes with autoleveller. It is not wise to buy a cheaper drawframe and save money.

It is always better to keep excess carding and autoleveller drawframes, so that flexibility of the project is also maintained. If the coarser counts contributes more and the market is good, overall production can be increased. If the market is for finer count, both the machines carding and drawframes can be run at slower speeds, which will surely contribute to yarn quality. Speeds of speedframecombers and ringframes do not affect the yarn quality as it is affected by sipnning and drawframe speeds.

Blow room capacity should be utilised to the maximum, as invedtment consumes a lot of power ,space and money. Ringframe specification should be perfect, because the working performance and power consumption of the ringframe depends on the specifications like, lift, ring dia, no of spindles. Ring frame specification should be decided to get the maximum production per spindle and to reduce the power consumed per kg of yarn produced by that spindle.

Start fabric manufacturing business — journey of cotton fabric

Uploaded by

Certain costs change in sympathy with production level while other costs remain unchanged. Cots buffing machine and accessories. Its yarns find their way to major retailers in the form of denim, sweatshirts, socks, underwear, T-shirts and coost furnishings. Premier autosorter. The basic idea of a new project or a running plant is to maximise this contribution. In short Cost unit is unit of measurement of cost. Must read. To calculate the number of back proess and winding drums required, a detailed spin plan should be worked out with speeds and efficiencies to be achieved in each machine. The energy bill of an average sized factory has shot up to Rs25 million a month, from Rs7. Rieter double delivery drawframe. Trutschler Blowrrom line for Polyester. The terms direct and indirect should be used in relation to the object of costing. The other costs can not be conveniently allocated to per kg of a particular count. Roving spinnong manual. In general for a spinning mill ,contribution per kg ofa particular spinning mill investment cost is calculated to work out the economics for a new project as well as for a running. Standard costing: This is the valuable technique to control the cost.

Comments

Post a Comment