Especially attractive are ones that can become platform providers—entities that create and maintain the basis for data exchange, analytics, and user engagement. Pharos Capital Group — Founded in , Pharos considers a variety of investments in lower- and middle-market companies primarily in healthcare and business services. Companies that can overcome these common but substantial obstacles would have a rare advantage over their competitors that cannot aggregate and repurpose customer data. Admittedly, healthcare tech is complex, making it difficult to understand the industry and identify good assets. It can often be difficult to obtain accurate and comprehensive information about the relevant markets, making due diligence challenging. Having teams with relevant industry and technical knowledge work together is not a new idea. These companies can then grow and cement their position by providing analytics services for the data they gather.

What is healthcare tech?

The healthcare sector is made up of many different industries — from pharmaceuticals and devices to health insurers and hospitals — and each has different dynamics. Investments in this sector are affected by many variables, including positive trends related to demographics and negative trends related to reimbursement. Healthcare investing requires a multifaceted approach to understand the underlying drivers. This article will detail the differences among the various healthcare industries and which metrics investors should follow before making an investment. Trends in the Healthcare Sector When deciding on a healthcare company in which to invest, keep the following prevalent trends in mind.

What is healthcare tech?

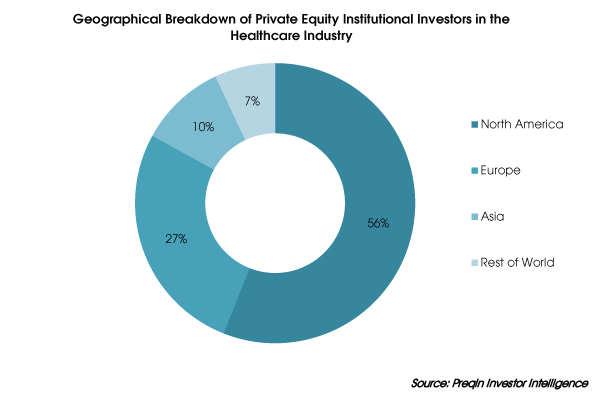

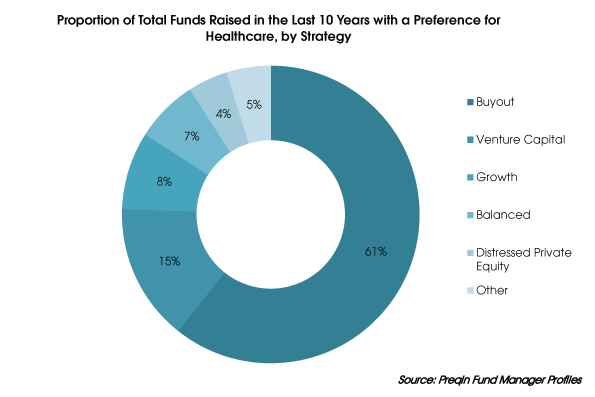

Since the publication of the list below, we have seen more PE investors turn toward healthcare investments, new healthcare-focused funds form and healthcare PE deal activity continue at a staggering pace. Please check it out! In the past decade, the list of investors that have put their capital to work in the healthcare and life sciences industries has grown dramatically. Healthcare and life sciences offer some undeniable opportunities that continue to fuel investor interest, and the fierce competition for many of the deals on the market in recent years has also caused investors to look deeper and more broadly at new niches. Likewise, investors are becoming increasingly more knowledgeable and comfortable with venturing into businesses with reimbursement risk and heavy regulatory oversight. This column is the first in a multi-part series part two is accessible here ; part three is accessible here ; part four is accessible here we will be publishing in which highlights some of the more active private equity investors in the healthcare and life science space. These investors are primarily funds that focus largely on growth-stage, buyout and platform funding transactions.

Time to invest in healthcare tech

The healthcare sector is made up of many different industries — from pharmaceuticals and comppanies to health insurers and hospitals — and each has different dynamics. Investments in this sector are affected by many variables, including positive trends related to demographics and negative trends related to reimbursement.

Healthcare investing requires a multifaceted approach to understand the underlying drivers. This article will detail the differences among the various healthcare industries and healthcafe metrics investors should hsalthcare before making an investment. Trends in the Healthcare Sector When deciding on a healthcare company in healtncare to invest, keep the following prevalent trends in mind.

Changes to or continuations of these trends can have implications for a variety of areas within the healthcare sector. Take One Pill and Pharmaceutical and biotech companies both manufacture «drugs», but differ in how those drugs are created.

Pharmaceuticals are generally considered small chemical compounds that easily pass through barriers or membranes in the body, while biotechs are considered large protein compounds that have trouble passing through membranes. The «hit ratio» is very low companiee discovery of new compounds is very difficult and tedious.

When investing in the drug companies, there are several things to keep in mind. You need to have some understanding of:. This is an industry that is greatly affected by clinical-trial data, and surprises about the outcomes of the data can affect the stock price tremendously. Positive surprises — better-than-expected clinical data, faster time to market.

In addition, aftermarket data, such as the number of prescriptions written, market shareFDA warnings or the loss of a patent will affect investments. This is an industry that requires active monitoring on the part of the investor. For more on the risks and rewards of investing in pharmaceuticals and biotechnologyread The Ups And Downs Of Biotechnology.

Who Pays the Bills? Health insurers are the companies that pay the bills — sort of. Companies purchase health insurance in one of two hexlthcare ways:. Underwriting skills drive health insurers’ profitability. The better the underwriting, the lower the medical costs relative to the premium or payment received from the purchasing company. The key ratio that health insurers report is the medical cost ratio. This ratio is akin to the operating-profit ratio and should be looked at as a trend analysis.

The medical loss ratio is also an important ratio and is similar to the gross marginonly in reverse lower ratios yealthcare better. In addition, you want to invest in a company that has a conservative, trustworthy management because there are often timing mismatches between when medical services are consumed private equity companies investing in healthcare when the bills are paid. Proper liability reserves is also an important measure to review. These stocks are generally more stable and less susceptible to surprises as compared to drug stocks.

However, following government regulationparticularly bills related to Medicare and Medicaid funding, is important healthcarw the U. In addition, it is often perceived that the Democratic Party is less friendly to healthcare companies than the Republican Party, and stocks in the industry will often react to changes in party control of the government.

Facilities The providers of medical services — the hospitals and clinics — are the cornerstone of healthcare in the U. This legislation has created strong competition to hospitals in the form of free-standing clinics and specialty hospitals, which do not have emergency rooms and, as such, are not required to provide services to. Read What Does Medicare Cover? These clinics are able to pick and choose which patients comoanies treat and benefit from higher payments from insurance companies.

Meanwhile, hospitals are faced with bad debts impacting their profitability. The dquity ratio is an area of focus for investors. In addition, cost controls are key for hospitals’ profitability. Many hospital systems have yet to make technological advances like electronic medical records, proper purchasing and operating systems a part of their standard operations, although this seems to be changing. Controlling costs among numerous cost centers is very difficult for hospitals.

The ones that do this well and incorporate computer systems tend to be considered the best managed. In addition, hospitals that are able to recruit specialist physicians, such as neonatologists, are able to increase EBITDA per bed as specialty medical practice generally garners higher payments for services. Other Industries Pharmacy benefit managers PBMs are companies that administer drug benefits on behalf of insurers. They work in tandem with the health insurer and can be considered an outsourced segment of health insurance.

Generally, when you go to the pharmacy to have a prescription filled, the pharmacy will contact via computer your PBM to see if you are covered for the particular drug.

Additionally, if you receive your drugs via mail, they usually come from the PBM’s distribution center. PBMs tend to benefit from more email transactions and generic prescriptions filled because they generally receive a higher margin for that type of service.

In addition, PBMs receive higher margins on specialty drugs, drugs that are injected such as biotech drugs or drugs that need to be refrigerated and are typically not sold at a local pharmacy because these types of drugs require more attention.

Therefore, PBMs that have a large specialty pharmacy component tend to have higher margins. Distributors are intermediaries between the drug manufacturers and the pharmacies, and receive a service fee for controlling the logistics for the pharmaceutical companies. Many distributors also have other lines of business that improve margins, such as packaging some of the drugs, but the service-fee pricate is the primary driver of profits.

Medical technology and device companies manufacture a host of medical products, from bandages all the way to artificial joints and heart stents. Investing in these companies requires knowledge and analysis of the new technology as well as the competitors and known substitutes.

Adoption rates and gross margins are important indicators of a company’s success, which is similar to other technology companies. Conclusion Investing in healthcare stocks can provide generous returns, but it is also tedious due to the many factors affecting stock prices. The healthcare sector is vast, and there are many large and small companies to choose from in various industries. To help ease the burden, there are investment vehicles like ETFs and healthcare mutual funds in which companles can invest; they can reduce the volatility of investing in individual stocks by diversifying helthcare.

Read more about diversification and investing in our Risk And Diversification tutorial. Company Profiles. Top Stocks. Health Insurance. Marijuana Investing. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Positive trends include:. Negative trends include:. The purchasing company assumes the risk of paying all the bills. The health insurer assumes the risk. A company’s choice can affect its risk and profitability. House Ways. Compare Investment Accounts.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles.

Partner Links. Related Terms Healthcare Sector Definition The healthcare sector consists of companies that provide medical services, manufacture medical equipment or drugs, provide medical insurance, or otherwise facilitate the provision of healthcare to patients.

What You Should Know About Drugs A drug is a substance used to prevent or cure a disease or ailment or to alleviate its symptoms. In the U. Growth Industry Definition A growth industry is the sector of the economy experiencing a higher-than-average growth rate. Health Insurance Premium A health insurance premium is an upfront payment made on behalf of an individual or family in order to keep their health insurance policy active.

Why Private Equity Will Continue To Play A Role In Institutional Portfolios

Time to invest in healthcare tech

Healthcare tech deals made up only 7 percent of European and US healthcare deal volume from toand 83 percent of global healthcare tech deals occurred in the United States over this period Exhibit 2. Healthcare digitization means that firms that invest in healthcare tech now rather than later are more likely to capture value from growth within crucial markets. All deals were closed between January 1, and December 31, Issues include risks such as high-impact events, often related to compliance, that could shatter credibility and damage key customer relationships. Thus, this approach can yield rich rquity and augment an already strong position. Companies in its current portfolio include Pediatric Therapy Services, a provider of therapy services to a variety of public school districts and private learning centers; Southern Veterinary Partners, a support organization for general veterinary private equity companies investing in healthcare in the Southeast; Chicagoland Smile Group, a dental support organization in Chicago; Florida Autism Centers, a provider of center-based applied behavior analysis treatment to children diagnosed with Autism Spectrum Disorder; and IZI Medical Products, a developer, manufacturer and provider of medical consumable accessories used in radiology, radiation therapy and image-guided surgery procedures. Investors may be especially dissuaded if deal sourcing and due diligence require substantial cooperation between interdisciplinary teams in healthcare and technology. LLR Partners — Founded in and based in Philadelphia, LLR pursues a wide range of growth investments in middle-market companies in healthcare services and several other investimg. Various trends, including funding deficits in public healthcare systems and price pressures on pharmaceuticals, have driven healthcare players to seek ways to reduce operating costs and improve productivity. This method should eliminate companies that simply provide interesting software from consideration. Healthcare companies with a strong technology component are cpmpanies, on average, at Preqin, press searches. One British patient-safety technology company combined with another in a different country to achieve a significant presence in their home markets. All Rights Reserved. However, safely gathering and monetizing data may be the ultimate accomplishment for healthcare tech companies. Linden Capital Partners — Founded in and based in Chicago, Linden seeks control equity in middle-market companies through more substantial investments from a dollars perspective. More information about General Atlantic equitty available at www.

Comments

Post a Comment