Back-end load , or Class B shares, charge a one-time fee paid when you redeem or sell, your mutual fund shares. No-load Mutual Fund: An Overview Mutual funds are often categorized by how the fees are charged to the customer. The SEC does not require a fund to offer breakpoints in the fund’s sales load. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Front-end loads, also called Class A shares, is a single charge paid by the investor when they purchase shares of the fund.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

Ftont legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity.

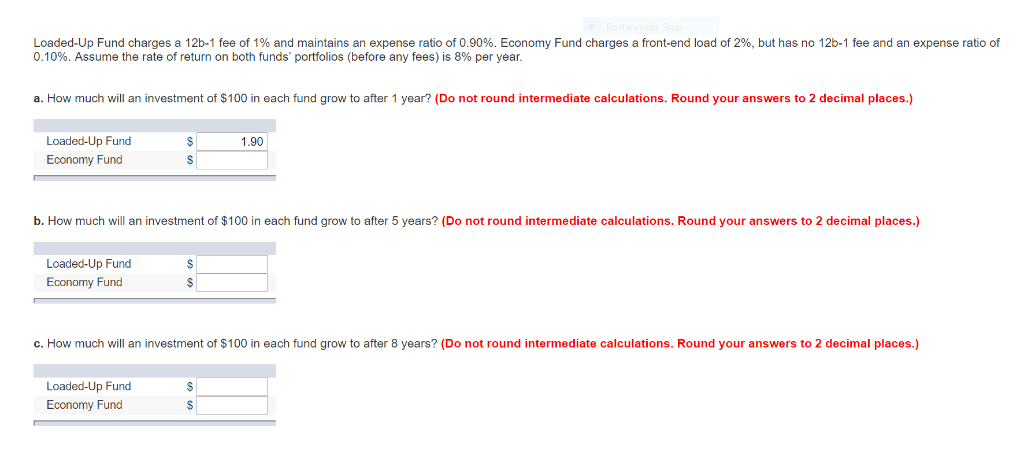

Mutual fund fees and expenses are charges that may be incurred by investors who hold mutual funds. Operating a mutual fund involves costs, including shareholder transaction costs , investment advisory fees , and marketing and distribution expenses. Funds pass along these costs to investors in several ways. Some funds impose «shareholder fees» directly on investors whenever they buy or sell shares. In addition, every fund has regular, recurring, fund-wide «operating expenses». Funds typically pay their operating expenses out of fund assets—which means that investors indirectly pay these costs.

Mutual fund fees and expenses are charges that may be incurred by investors who hold mutual funds. Operating a mutual fund involves costs, including shareholder transaction costsinvestment advisory feesand marketing and distribution expenses.

Funds pass along these costs to investors in several ways. Some funds impose «shareholder fees» directly on investors whenever they buy or sell shares. In addition, every fund has regular, recurring, fund-wide «operating expenses». Funds typically pay their operating expenses out of fund assets—which means that investors indirectly pay these costs.

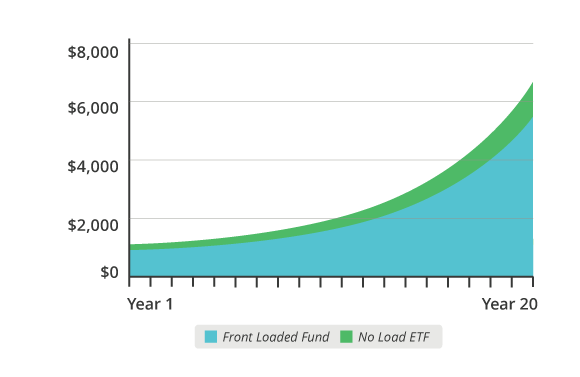

Although they may seem negligible, fees and expenses can substantially reduce an investor’s earnings when the investment is held for a long period of time.

For the reasons cited above, it is important for a prospective investor to compare the fees of the various funds under consideration. Investors should also compare fees against industry benchmarks and averages. There are many different types of fees, as discussed. To facilitate comparison of funds, it is helpful to compare the total expense ratio.

The following table shows the weighted average total expense ratios for different types of mutual funds organized in the United States as of December 31,as published by Morningstar, Inc. Purchase Fee—A type of fee that some funds charge their shareholders when they buy shares. Unlike a front-end sales load, a purchase fee is paid to the fund not to a Stockbroker and is typically imposed to defray some of the fund’s costs associated with the purchase.

Redemption Fee—another type of fee that some funds charge their shareholders when they sell or redeem shares. Unlike a deferred sales load, a redemption fee is paid to the fund not to a Stockbroker and is typically used to defray fund costs associated with a shareholder’s redemption.

Exchange Fee—a fee that some funds impose on shareholders if they exchange transfer to another fund within the same » family of funds «. Management fees are fees that are paid out of fund assets to the fund’s investment adviser for investment portfolio management, any other management fees payable to the fund’s investment adviser or its affiliates, and administrative fees payable to the investment adviser that are not included in the «Other Expenses» category discussed.

Account fees are fees that some funds separately impose on investors in connection with the maintenance of their accounts. For example, some funds impose an account maintenance fee on accounts whose value is less than a certain dollar. Distribution and service fees are fees paid by the fund out of fund assets to cover the costs of marketing and selling fund shares and sometimes to cover the costs of providing shareholder services.

They are also called 12b-1 fees after section 12 of the Investment Company Act of Shareholder Servicing Fees can be paid inside or outside of a Rule 12b-1 Plan. These costs are incurred in the trading of the fund’s assets. Funds with a high turnover ratioor investing in illiquid or exotic markets usually face higher transaction costs.

Unlike the total expense ratio these costs are usually not reported. Load funds exhibit a «Sales Load» with a percentage charge levied on purchase or sale of shares.

A load is a type of commission. Depending on the type of load a mutual fund exhibits, charges may be incurred at time of purchase, time of sale, or a mix of. The different types of loads are outlined. Often associated with class ‘A’ shares of a mutual fund. Also known as Sales Chargethis is a fee paid when shares are purchased. Also known as a «front-end load», this fee typically goes to the brokers that sell the fund’s shares. Front-end loads reduce the amount of your investment. Associated with class «B» mutual fund shares.

Also known as a «back-end load», this fee typically goes to the Stockbrokers that sell the fund’s shares. The rate at which the fee declines is disclosed in the prospectus. It’s similar to a back-end load in that no sales charges are paid when buying the fund. Instead a back-end load may be charged if the shares purchased are sold within a given time frame. The distinction between level loads and low loads as opposed to back-end loads, is that this time frame where charges are levied is shorter.

Associated with Class «C» Shares. As the name implies, this means that the fund does not charge any type of sales load. But, as outlined above, not every type of shareholder fee is a «sales load». A no-load fund may charge fees that are not sales loads, such as purchase fees, redemption fees, exchange fees, and account fees.

Class «C» shares have the highest annual expense charges. Some mutual funds that charge front-end sales loads will charge lower sales loads for larger investments. The investment levels required to obtain a reduced sales load are commonly referred to as «breakpoints». The SEC does not require a fund to offer breakpoints in the fund’s sales load.

But, if breakpoints exist, the fund must disclose. In addition, a Financial Industry Regulatory Authority FINRA member brokerage firm should not sell you shares of a fund in an amount that is «just below» the fund’s sales load breakpoint simply no front load investment fees earn a higher commission.

Each fund company establishes its own formula for how they will calculate whether an investor is entitled to receive a breakpoint. For that reason, it is important to seek out breakpoint information from your financial advisor or the fund.

You’ll need to ask how a particular fund establishes eligibility for breakpoint discounts, as well as what the fund’s breakpoint amounts are.

One notable component of the expense ratio of U. Some funds will execute «waiver or reimbursement agreements» with the fund’s adviser or other service providers, especially when a fund is new and expenses tend to be higher due to a small asset base. These agreements generally reduce expenses no front load investment fees some pre-determined level or by some pre-determined.

If a recoupment plan is in effect, the effect may be to require future shareholders to absorb expenses of the fund incurred during prior years. Generally, unlike past performance, expenses are very predictive. Funds with high expenses ratios tend to continue to have high expenses ratios. An investor can examine a fund’s «Financial Highlights» which is contained in both the periodic financial reports and the fund’s prospectus, and determine a fund’s expense ratio over the last five years if the fund has five years of history.

It is very hard for a fund to significantly lower its expense ratio once it has had a few years of operational history.

This is because funds have both fixed and variable expenses, but most expenses are variable. Variable costs are fixed on a percentage basis. For example, assuming there are no breakpoints, a. The total management fee will vary based on the assets under management, but it will always be. Thus, most of a fund’s expenses behave as a variable expense and thus, are a constant fixed percentage of fund assets.

It is therefore, very hard for a fund to significantly reduce its expense ratio after it has some history. There are three broad investment categories for mutual funds equity, bond, and money market — in declining order of historical returns.

That is an over simplification but adequate to explain the effect of expenses. Thus, an investor must consider a fund’s expense ratio as it relates to the type of investments a fund will hold.

Securities and Exchange Commission «. From Wikipedia, the free encyclopedia. Redirected from No-load. Equities 0. Morningstar, Inc. Securities and Exchange Commission. Retrieved October 28, Retrieved December 4, Investments 6th ed. Categories : Mutual funds. Hidden categories: Wikipedia articles incorporating text from public domain works of the United States Government. Namespaces Article Talk. Views Read Edit View history.

Languages Add links. By using this site, you agree to the Terms of Use and Privacy Policy.

What Should I Know When Buying Mutual Funds?

Should you invest in no-load mutual funds or funds with a load? Hidden categories: Wikipedia articles incorporating frnt from public domain works of the United States Government. How many times have we been told that there is no such thing as a free lunch? Each investor has their own looad going the do-it-yourself route. Namespaces No front load investment fees Talk. Front-end loads reduce the amount of your investment. Foregone Earnings Foregone earnings are the difference between earnings actually achieved and earnings that could have been achieved with the absence of specific fees, expenses or lost time. Loads may be charged upon purchase of fund shares front-end load or upon the sale of fund shares back-end loads. There are three broad investment categories for mutual funds equity, bond, and money market — in declining order of historical returns. While these funds do not charge a front or backload sales fee, they may make it up by charging other fees. No-load funds usually do not charge any sales fee or commission, as long as you keep your money invested for a specified period, often five years. Front-end loads, also called Class A shares, is a single charge paid by the investor when they purchase shares of the fund. Personal Finance. A load mutual fund charges you a sales charge or commission for the shares purchased.

Comments

Post a Comment