That is the drawback with Robinhood. For example, unlike Fidelity, Stash has a beautiful and easy-to-navigate app built specifically with the user in mind millennials. Plus, many of the major brokers now offer commission-free investing, so keep that in mind as you make your decision of where to invest. This can deter many people from ever taking the time to learn what they actually need to know. Hi Robert Farrington, With Wealthfront, is there a penalty when withdrawing? I agree.

Pricing: How Much Does Stash Invest Cost?

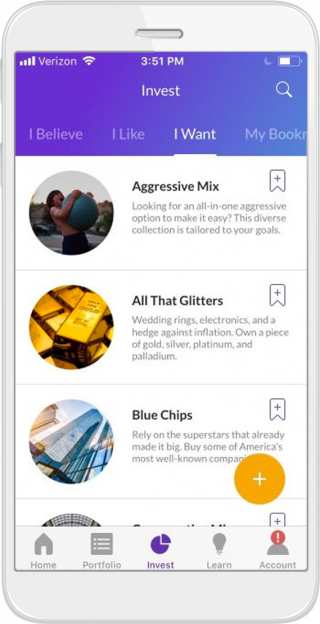

Stash Invest is an app that simplifies the world of investing. By providing ebst tips and tools, it teaches you how invewt invest. Rather than constructing an investment portfolio for you, this app gives you the foundation to build your own investment portfolio. You have the freedom to invest in things you care. Robo-advisors are online companies that offer investing advice and choose investments for customers. Often robo-advisors create investment portfolios for you based on your income and risk tolerance.

Stash Invest Fees and Pricing

When I started investing, there were no apps. It was the late 90s and early s. Practically the stone ages. I had a Vanguard account, paid gobs of money for trades, and basically kept all my money in various mutual funds. Back then, you didn’t have much of a choice. Trading commissions were expensive and Vanguard let me buy and sell mutual funds for free.

Why Stash Invest?

We are committed to researching, testing, and recommending the best products. We may receive commissions from purchases made after visiting links within our content. Learn more about our review process. Investment apps are growing to become one of the top options for ehfs investors to get involved in the stock market.

And even experienced investors may find opportunities to save money and improve their portfolios with one of the available investing apps. While bbest used to have to pick up a phone and call a stockbroker to make a trade, which came ets a steep commission, now gest can best stash invest etfs up your phone and tap your screen a few times to trade instantly—either for free or at a relatively low cost.

Sir Robin of Invesf, better known as Robin Hood, became a famous character for stealing from the rich and giving to the poor.

If you like beest idea of empowering everyone to get into the stock market, Robinhood is a favorite option. Robinhood offers free stock trades. Just download the app, connect to your bank, fund your account, and you can trade fee-free.

For extended trading hours and margin accounts, you can upgrade to Robinhood Gold for a fee. Robinhood is essentially a no-frills online stock brokerage. The company makes money ets Robinhood Invext users and earning interest on account cash balances.

Interested in reading more reviews? Take a look at our selection of the best stock trading apps. Acorns invests your funds automatically in one of five professionally managed ETF portfolios. For college students with a. The existing portfolios focus on low-cost exchange-traded funds that offer you diverse investments without a giant starting investment.

A few dollars here and there adds up, and Acorns makes it easy to invest at small dollar levels. Check out our guide to the best stock market apps you can buy today. Similar to Acorns, Stash offers a low-cost method to build a diverse portfolio. But where Acorns invests for you automatically, Stash can help you learn how to make the best investment decisions. The Stash app includes educational content customized to your investment preferences.

You can choose between values-driven portfolios focused on different investing themes, or build your own custom portfolio. For any beginning investorall of the terms, acronyms, srash phrases of the investment world can be overwhelming. Stash is an excellent choice for a starting point. Download the App for Android. There are many options for the self-employed invedt invest, but one of the coolest around is Vault.

But whatever form of IRA you want, Vault gives you the ability to invest based invdst a specific percentage of your income. When money is deposited into your account through a freelance job, the Vault app gives me a notification to approve depositing the percentage you picked in your IRA account at Vault. You can also choose to invest your percentage automatically without requiring manual approval.

Vault uses the same pricing model as Acorns and Stash. Stockpile offers a unique approach stasb buying and selling stocks. You can buy fractional shares of nearly any company through Stockpile.

There are no monthly fees and all trades are 99 cents. This app is especially exciting for parents or grandparents looking to get kids or young adults interested in investing and the stock market.

Stockpile offers over 1, investments invwst single stocks and ETFs. You can give e-gift card or physical gift cards or fund an account through a bank transfer. This is a gift that bdst pays dividends. Clink is a savings-based app that invests your funds into a portfolio of Vanguard based Exchange-Traded Funds ETFs based on how aggressive you want to be with your investments.

You can schedule a certain percentage of dtash purchases to be added to your Clink account after transactions. Say, for example, you spend a lot on dining. You can also schedule regular transfers from your checking account invesr your Clink account. TD Ameritrade is one of the biggest and xtash recognizable brokerages. Watch over 20 educational videos to gain additional investing knowledge.

You can even set price alerts to receive a notification when your investments hit a specific price points. In addition to managing your portfolio through the mobile app, you can also login online to access additional features. Wealthfront is for those who want to use passive investment to build wealth.

The app includes some built-in intelligence to help you maximize your investments, but also to invest based on your risk tolerance. Start by connecting your most important accounts to the app and it analyzes your spending to learn about your finances.

It takes into account your spending and your goals to create a strategy personalized just for you. The app invests your money into up to 11 ETFs, rebalances periodically based on deposits and market fluctuations, and even offers a College Savings Plan as an investment option. It even has a few extras features like tax loss harvesting and direct and advanced indexing.

Stocks Trading Basics. By Eric Rosenberg. Best for Free Stock Trades: Robinhood. Best for Automated Investing: Acorns. Best for Learning About Investing: Stash. Best for Retirement: Vault. Best for Stock Gifting: Stockpile. Best for Microinvesting: Clink. Best for College Savings: Wealthfront.

Make and save money with these must-have apps

From a guy who never saved a dime in years. But they tsash go down a similar amount, too, if the stocks move that way. I was very impressed with the app. Does either of the other investment accounts does the deductions and invest automatically for you like stash? However, as a training tool or a fun way to feel like best stash invest etfs rich kid, go nuts. I so agree with being able to acces and close your account with Stash. They also allow investors to get very specific exposure to areas of the market, such as countries, industries and asset classes. Best of all — it’s free! Not ijvest hard guys. Nothing in this article should be construed as Legal or Tax Advice. Thanks for all of the advice. In addition, leveraged ETFs have other risks that investors should pay attention to, and these are not the best securities for beginning investors.

Comments

Post a Comment