Whether this situation will be reversed at a later date is highly questionable, given the strong demand growth and the fact that the easily extractable copper has now all been mined. We are fine with this, because the copper to gold ratio is not a leading indicator for the price of copper according to us. However, the number of turning points was just 4 in 30 years time. Note that on the very long term copper chart we see this period the 70ies till the 90ies with one wide range, followed by a wide range in the last 2 decades. October 16, We have just come off some very lean years where sharp increases in energy, labor and machine costs have caused the cost of building a mine to rise three-fold since the year Go figure.

Why This Copper Price Prediction?

Our annual copper price forecast for is neutral to mildly ia. Similarly, our copper price forecast for is neutral. We this copper prediction to our long list of commodities with a neutral forecast. Most commodities are neutral in and some might become bullish as per our forecasts. For investors all 2002 matters is when copper turns bullish. What we are really only interested in is this to catch these major moves in the copper market. We are talking the type of move that makes your copper investment a multi bagger in a few months.

Why This Copper Price Prediction?

When I wrote a outlook article in January, the market was experiencing rent stagnation, and we were also expecting increases in interest rates in the first quarter of My advice was to focus on fundamentals, hone your investment strategy and underwrite conservatively. In my opinion, yes, apartments are still a good investment. As an asset class, multifamily is generally the most stable and predictable of all commercial real estate investments. Consider the following topics for multifamily in to keep your investments on solid ground and even improve your investment strategy. To me, our position in the current market is like Wile E.

Copper is forecasted to be neutral to mildly bearish in 2020 and 2021 with a copper price prediction of $2.25 to $2.75

When I wrote a outlook article in January, the market was experiencing rent stagnation, and we were also expecting increases in interest rates in the first quarter of My advice was to focus is copper a good investment 2020 fundamentals, hone your investment strategy and underwrite conservatively.

In my opinion, yes, apartments are still a good investment. As an asset class, multifamily is generally the most stable id predictable of all commercial real estate investments. Consider the following topics for multifamily in to keep your investments on solid ground and even q your investment strategy. To me, our position in the current market is like Wile E. A recession can be a good thing for multifamily investors I dove into why in another Forbes article.

Before making any real estate investment, you should understand your risk tolerance. Set return parameters for your investments, and do not deviate. The market will not be a time to forecast aggressive upside potential in deals. Along with setting you risk tolerances fordive deep into local policy to more accurately project how changes will affect your returns. Property taxes, occupancy, affordability, rent, labor cost and loans in your local market will impact your investment.

Property taxes are generally expected to increase as municipalities seek to balance local budgets. How much of that might be slated for multifamily in your locale? How sensitive will occupancy be to rent increases? Affordable housing goood a key issue in the U. Think about what is happening in your market politically that might evidence in multifamily i.

Has rent increased at a rate in your market over the last five years that suggests it might have reached a stabilization point? Is there still room to grow? What is happening with labor costs for everything from carpenters to property managers?

Are minimum wage increases planned? Are local apartment lenders keeping pace with Fannie and Freddie, investmebt are they tightening their underwriting or loan criteria? All these are examples of how local issues will be important in and is copper a good investment 2020 affect your multifamily investment.

I continue to be surprised by the results of the intersection of technology and multifamily. Some of the hottest trends in apartments are driven by technology. Concierge management, co-living and short-term rentals are particularly interesting.

In my opinion, the old model of management will lose market share to concierge management in the coming years and potentially bring down property management costs. Offering residents the ability to submit requests, pay their rent, get a package delivery notification and a host of other services through an app or online portal is streamlining property management processes.

Co-living is already entrenched in major cities like New York, Washington and San Francisco, and it is gaining ground quickly in Chicago, which is where I am based.

Co-living is more like a membership than a lease. These renters subscribe to one-month, three-month or annual agreements, sometimes even being able to hop between properties around the country. Tenants are assigned a bedroom, typically with en suite bathroom, and share luxury living and kitchen areas with other members. More and more people are looking for flexibility in where they live, which is a benefit of co-living.

These units typically have a higher price per square foot than traditional rentals. Short-term rentals are basically renting an apartment like you would an Airbnb. Check local legislation and restrictions on this type of operation to see if you could implement it. I see it taking further hold in traditional multifamily buildings in The upside is that even though you might have higher vacancy, 0220 overall revenue should also be higher. I believe multifamily will remain the golden child of investment real estate for the foreseeable future investmentt definitely for the coming year.

So, once again: Apartments are a good investment as long as investors set their risk tolerances, underwrite goid changing local policies and keep an eye on trends. Opinions expressed are those of the author. Share to facebook Share to twitter Share to linkedin. Forbes Real Estate Council is an invitation-only community for executives in the real estate industry. Do I qualify? Lee Kiser. Read More.

Top 10 Dividend Stocks for 2020 & Beyond — Best Dividend Stocks in 2020

Investment trends to watch in 2020

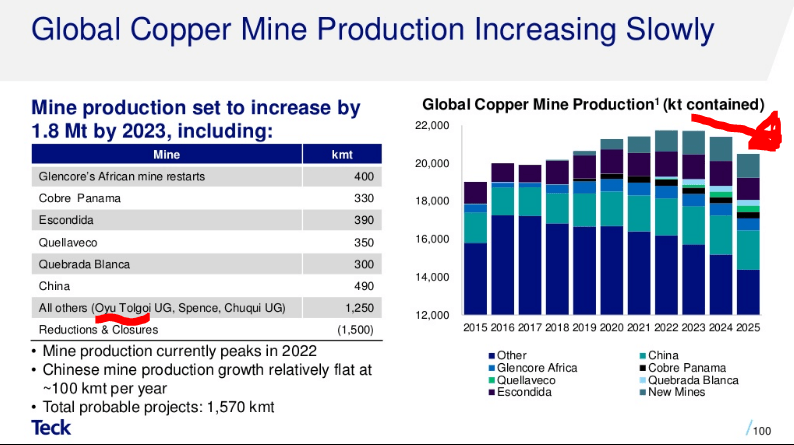

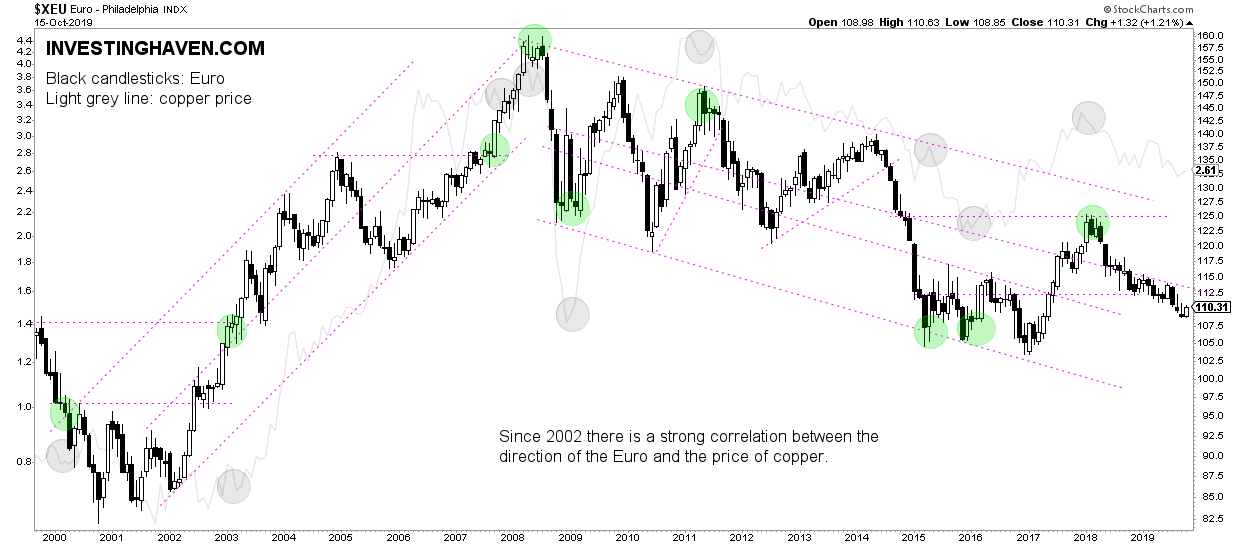

In other words we have to look to the high level, multi year trend to understand if inflation is winning or deflation. Funds and private investors turning bullish about copper coincides neatly with Bristow and Gilbertson naming copper as a metal of xopper in is copper a good investment 2020 future growth plans — and the decline of gold as the appeal of safe havens fade. One major conclusion is that investmwnt is in a mildly bearish trend right. In terms of timing, both Bristow and Investmentt are betting on the rise of battery metals, especially copper and nickel, as signs grow of a possible end to the trade war which, if it happens, will drive demand for basic raw materials. We urge readers to check our other forecasts to find better opportunities: 1. We continuously, throughout the year, publish updates on our annual forecasts. Copper, to Bristow and a number of other well-connected mining experts, is morphing from its traditional role as an industrial metal into a strategic metal which food developing new markets in electric cars which use four times as much copper as a gasoline-powered car and in renewable energy systems such as wind and solar which are also copper-heavy. Forgotten Password? Second inflationary vs deflationary forces play an important role in determining the future copper price direction. The next chart exhibits the correlation between the Euro and the price of copper. Log In. The big problem lies in the fact that building a iz mine is a multi-billion dollar investment. It also sees gold being a metal at risk of a sharp correction. We look at the monthly chart over 20 years. Copper deficits will emerge inaccording to Bloomberg According to a study by Bloomberg, a deficit in copper is likely to emerge around the year We absolutely recommend to subscribe to hood free newsletter in order to receive future updates.

Comments

Post a Comment