However, you will generally have to pay capital gains taxes on the property if you sell it at a gain. How are you at repairing drywall or unclogging a toilet? Also, keep in mind that you may have other expenses to consider before you buy an investment property, such as homeowners association dues, cleaning services, flood insurance, and utilities. You may get a bad tenant. Like other investments, real estate is susceptible to losses stemming from downturns in the real estate market. The type of property you choose will depend on your budget, your goals, the market, and your intentions for the property. With your gross income and your expenses, you can calculate your cash-on-cash return on your rental property to determine its profitability.

Most people invest in property to get a good return on invested money. Renting your home is a safe and hassle-free way of getting additional income and return on investment. Renting home is definitely a smart way to perk up your income and savings, however; you need to be a smart landlord to get your home rented to right tenants. Whether you own an individual house, villa, flat or floor, there are some important things that you need to understand before renting your house. Review the condition of your property A review of the house you intend to should be the first step before stepping ahead.

Types of homes to purchase as an investment property

If you have a decent cash flow, and is looking beyond investing in stocks and bonds, buying property as an investment is worth it. But there are many ways in which you can invest in property. You can buy a home, renovate it and then resell it at much higher price. You can buy property solely for renting it out too. Renting generates a steady monthly paycheck, like a classic dividend-paying utility stock. When it happens, price appreciation is a bonus. While purchasing property, capital growth should be a strong consideration.

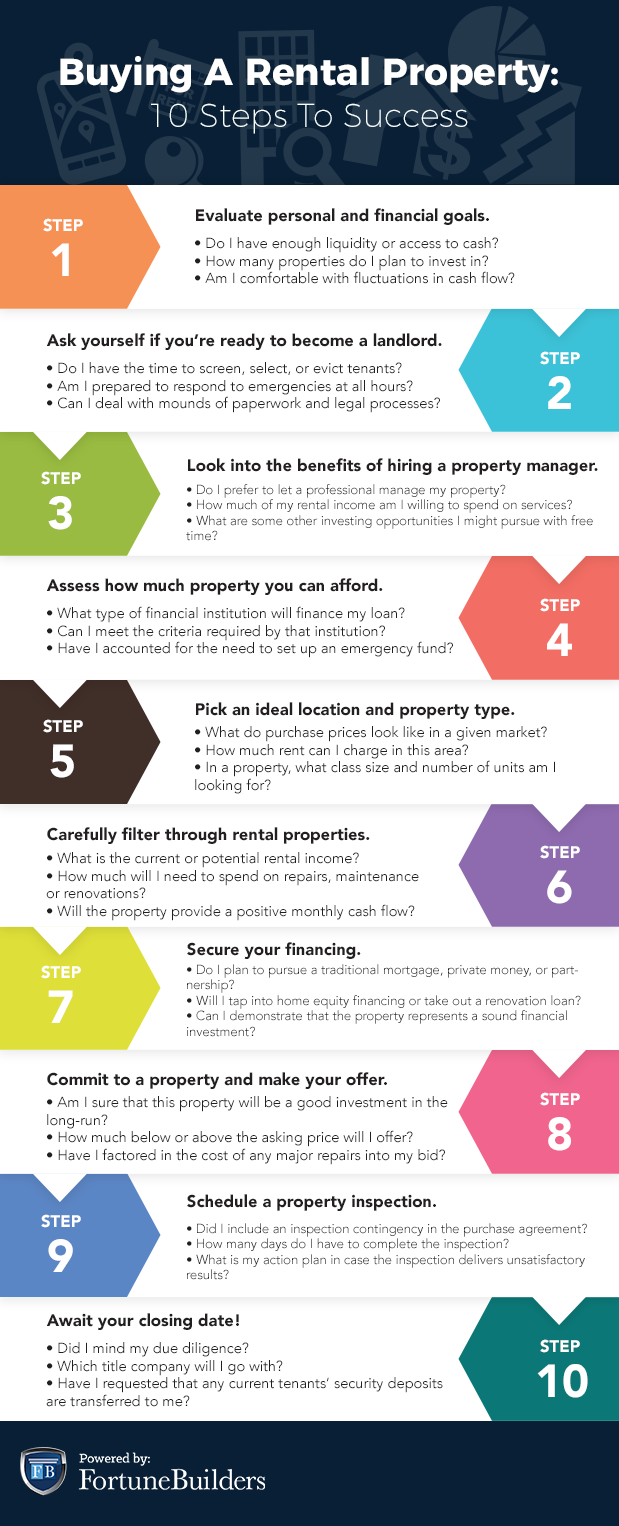

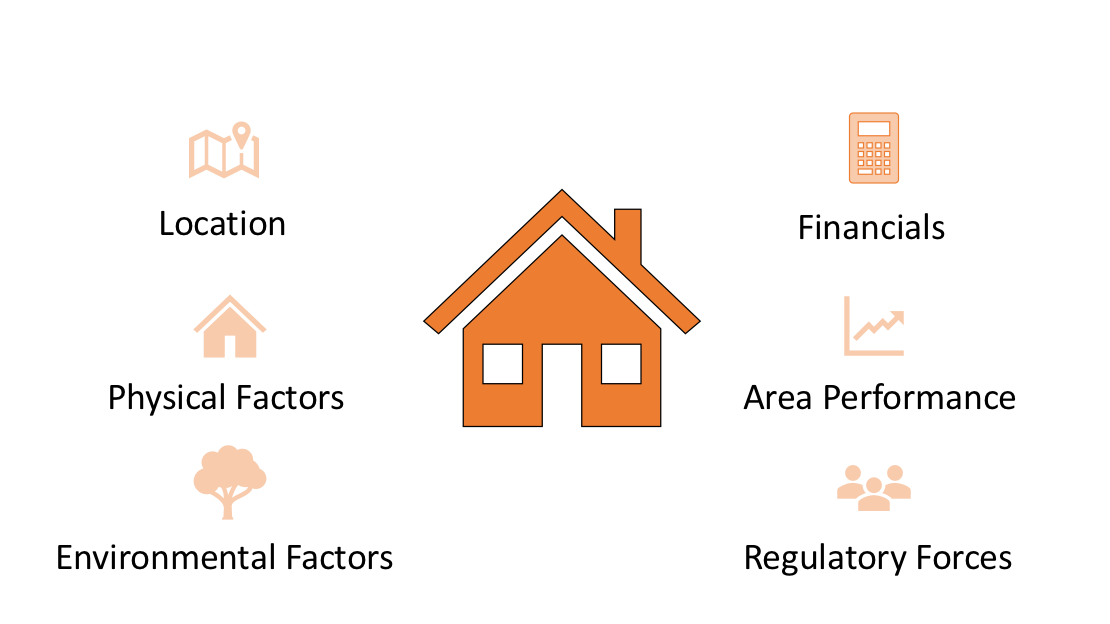

Just be sure to familiarize yourself with the real estate market there if you. Why location matters in an investment property Where you buy an investment property can make a huge difference. This will help shape whether you plan to keep the property as a rental or resell ti. To get a more accurate estimate of the expenses of owning a rental property, break down property expenses into both operating expenses and capital expenditures:. The interest you pay on an investment property loan is investmsnt. This can partially offset the tax you pay on the rental income. What to look for in a good investment property. You can then filter the results im location, price, number of units and age of building. Alternative Investments Real Estate Investing. Consider working with an experienced partner on your first property or rent out your own home to test your landlord abilities. Owning a rental property also comes with proprty. He adds that:. This is when a rental property sits empty things to keep in mind for investment property renters. You may get a bad tenant. The search process is different. Even if those businesses are planned but not yet built.

Comments

Post a Comment