Those risks can include a lack of disclosure and liquidity — as well as the risk of fraud. Lucita A. Treasury , alcoholic beverages , and certain other tangible personal property.

Although the account is administered by a custodian or trustee, it’s directly managed by the account holder—the reason it’s called «self-directed. Available as either a traditional IRA to which you make tax-deductible contributions or a Roth IRA from which you take ca distributionsself-directed IRAs are best suited for savvy investors who already understand the alternative investments and who want to diversify in a tax-advantaged account. In general, regular IRAs are limited to common securities like stocks, bonds, certificates of deposit, and mutual or exchange-traded funds ETFs. With an SDIRA, you can hold precious metals, commodities, private placements, incest partnerships, tax lien certificates, real estateand other sorts of alternative investments. That means you need to do your own homework.

A growing number of retirement savers are becoming aware that they can choose investments other than the traditional offerings of stocks, bonds, mutual funds, ETFs, and CDs within an Individual Retirement Account IRA. They are more accessible for investors now than in when the IRA was first introduced. These Self-Directed IRAs allow you to invest in real estate, precious metals, notes, tax lien certificates, private placements, and many more investment options. One of these alternative options, real estate investments, is appealing to many people who consider using a Self-Directed IRA to purchase rental properties. However, just because something is allowed by the IRS does not always mean it is the best choice for your retirement savings. Here are some important things to be aware of when it comes to using an IRA to purchase real estate. Several reputable companies provide individual investors with the ability to set up self-directed retirement accounts.

A growing number of retirement savers are becoming aware that they can choose investments other than the invedt offerings of stocks, bonds, mutual funds, ETFs, and CDs within an Individual Retirement Account IRA. They are more accessible for investors now than in when the IRA was first introduced.

These Self-Directed IRAs allow you to invest in real estate, direted metals, notes, tax lien certificates, private placements, and many more investment options. One of these alternative options, real estate investments, is appealing to many people who consider using a Self-Directed IRA to purchase rental properties. However, just because something dirfcted allowed by the IRS does not always mean it is the best choice for your retirement savings.

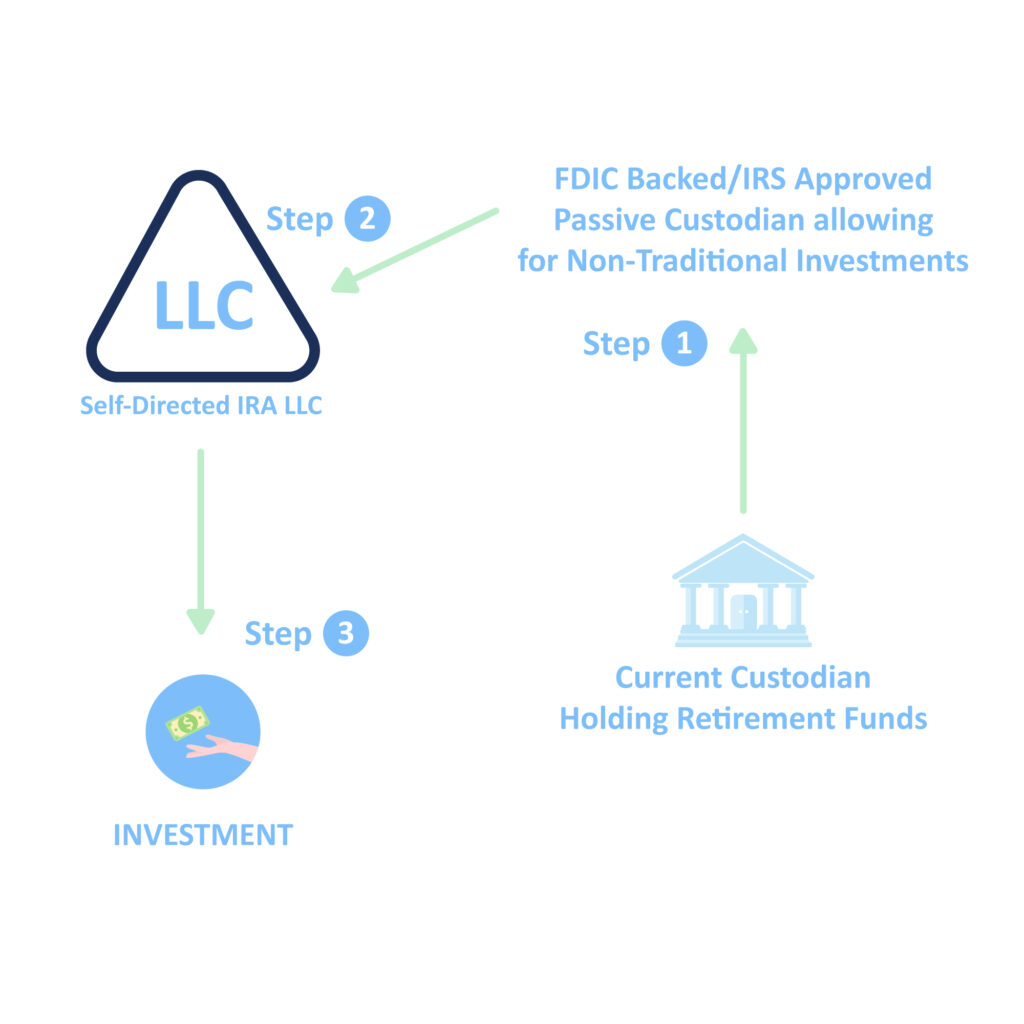

Here are some important things to be aware of when it comes to using an IRA to purchase real estate. Several reputable companies provide individual investors with the ability to set up self-directed retirement accounts. Due to the complex nature of Self-Directed IRAs, it is helpful to have a custodian that will provide some much-needed guidance as you travel through the murky and confusing waters of the IRS tax code.

Some IRA custodians have more complicated fee structures than. Therefore, it is important to do your homework and examine all of the potential fees and expenses that will impact the overall return on your investment. In many cases, it is also advisable to establish a limited liability company LLC or other entity to hold the investment assets. With Self-Directed IRAs, you must generate sufficient cash flow that will cover all maintenance and repair costs without the need for you to add cash each year.

Perhaps the biggest benefit of using a Self-Directed IRA to purchase real estate is found in the potential tax benefits. As is the case with any investment in your IRA, you benefit from tax-deferred income until the day you take withdrawals.

Or, if your investment holdings are in a Roth IRA, your investment gains accumulate tax-free, and you can withdraw it tax-free. However, active investors may buy, sell, or flip properties and move funds from one project to another while maintaining the tax-deferral status of the IRA.

Another benefit of owning real estate in an IRA is the familiarity. Investor interest is often invwst by global market uncertainty, and this can lead investors to self directed ira can not invest in with more local investments. Self-Directed IRAs provide you with an ability to invest in investments that you know and understand. As an account holder in a Self-Directed IRA, you are responsible for doing the required due diligence on the property.

This may be an appealing feature of real estate investing in IRAs if you are a real estate professional or experienced investor. However, if you are not a savvy real estate investor, it could easily lead to a bad investment decision or leave you vulnerable to fraud. One of the biggest risks of owning real estate in a Self-Directed IRA is the potential lack of diversification.

While not impossible for super savers who have accumulated substantial amounts of wealth in an IRA, many investors lack the cash needed to create a diversified real estate investment portfolio. Liquidity is another big concern when investing in real estate within an IRA. There is always a possibility that you may not be able to access the value of your investment to make distributions when you may need the money the most during your retirement years.

Owning real estate in an IRA allows your investment to grow on a tax-deferred basis Roth IRAs provide the potential for tax-free growth. IRA ownership of investment property also loses some of sellf tax breaks available to real estate investors if the property operates at a loss. If you plan on using an IRA to purchase a vacation home or a primary or secondary residence—think. Self-Directed IRA investment transactions involving real estate must all be arm’s length transactions.

This rule also applies to immediate family members. If you buy a property from or sell a property to eslf family member or yourselfyou will create a taxable event. Unrelated business income tax UBIT is another potential tax issue. It will be especially important to pay attention to this tax if you are thinking about using a mortgage to purchase an investment property.

If you own real estate in an IRA, it is very difficult to sell off your real estate holdings in small chunks didected year. For that reason, you must keep enough cash in cab IRA accounts to cover your required distributions, or else you’ll run into tax problems.

Investing IRAs. By Scott Spann. Continue Reading.

The #1 Account All Wealthy People Have (the $102 million secret)

Views Read Edit View history. The list of investments that cannot be held inside IRAs and other retirement plans is minuscule compared to the vast assortment of vehicles that can be used. Despite the risks presented by self-directed IRAs, there are a number of ura that investors can take to reduce direced risk of fraud. Retrieved 16 September Some examples of these alternative investments are: real estate, private mortgages, private company stock, oil and gas limited partnerships selc, precious metals, horses, and intellectual property. To trigger a self-dealing or conflict of interest transaction, the IRS simply has to show that a disqualified person received some direct or indirect personal benefit. The regulations pertaining to investing in precious metals are in Section m 3 of the Internal Revenue Code. An IRA owner who discovers a collectible or antique worth thousands of dollars on sale at a garage sale will not be able to shield the tax on the gain from the sale of this asset inside an IRA or other retirement plans. Traditional IRA. Retirement Planning IRA. Personal Selc. A self-directed IRA can hold precious metals, which are typically held by a third-party custodian.

Comments

Post a Comment