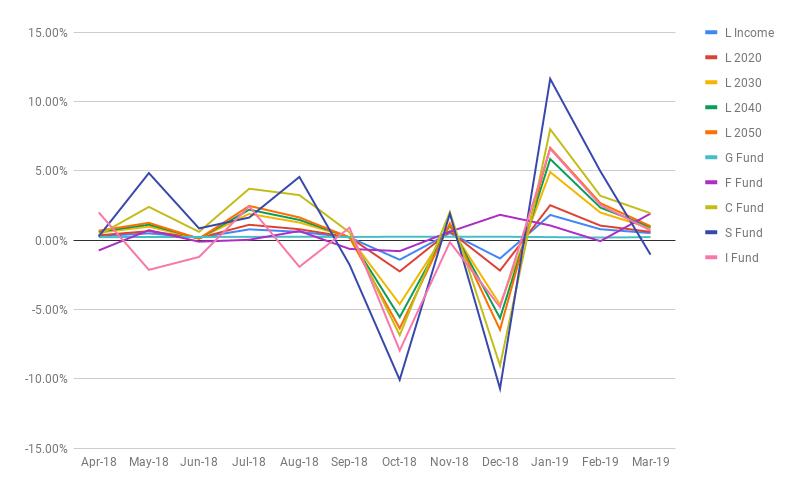

Small Capitalization Stock Fund. Additionally, smaller company stocks generally benefit less from share buybacks than large, profitable companies. Your Practice. Volume TSP Investment Programs. Right now, smaller companies are the ones facing more pressure.

Currently their are 5 individual funds and 5 Life Cycle funds to choose. Each fund, described tssp, has its own unique characteristics. Each of the L Funds includes a predetermined mix of the stand along funds and the Life Cycle funds are designed to automatically rebalance the fund each quart. The closer you get to retirement the more conservative the fund mix. The G Fund is invested in short-term U. Treasury securities.

This article breaks down the five core investment funds available in the TSP along with the Lifecycle funds and their proper use. Four of the five funds are index funds , which hold securities exactly matching a broad market index. The five funds are broken down as follows:. This is the only core fund that does not invest in an index. The average maturity is about 11 years, and the aggregate interest rate is adjusted monthly.

Currently their are 5 individual funds and 5 Life Cycle funds to choose. Each fund, described below, has its own unique characteristics. Each of the L Funds includes a predetermined mix of the stand along funds and the Life Cycle funds are designed to automatically rebalance the fund each quart. The closer you get to retirement the more conservative the fund mix. The G Fund is invested in short-term U.

Treasury securities. It gives you the fjnd to earn rates of interest similar to those of long-term Government securities with no risk of loss of principal. Payment of invesstment and interest is guaranteed by the U.

Interest on the G Fund is calculated as the weighted average yield of all U. Treasury securities with more than 4 years to maturity; the interest rate changes monthly.

Resources: G Fund investment performance. Stoxk Index. Government, mortgage-backed, stpck, and foreign government sectors of the U. This fund offers you the opportunity knvestment earn rates of return that exceed money market fund rates over the long term particularly during periods of investmeng interest rates.

Resources: F Fund investment performance. This is a broad market index made up of the stocks of large to medium-sized U. It offers you the potential to earn high investment returns over the long term. Resources: C Fund investment performance. This is a broad market index of small and medium-sized U.

It offers you the stoci to earn potentially higher investment returns over the long term than you would in the C Fund, but with greater volatility. Resources: S Fund investment performance. This is a broad international market index, made up of primarily large companies in 21 developed countries. It gives you the opportunity to invest in international stock markets with the potential to earn high investment returns over the long term.

Resources: I Fund investment invesfment. Features The G Fund offers the opportunity to earn rates of interest similar to those of long-term Government securities but without any risk of loss of principal and very little volatility of earnings. The objective of the G Fund is to maintain a stoxk return than inflation without exposing the fund to risk of default or changes in market prices.

Treasury securities specially issued to the TSP. Earnings consist entirely of interest income on the securities. Features The F Fund offers the opportunity to earn rates of return that exceed those of money market funds over the long term particularly during periods of declining interest rateswith relatively low risk. Aggregate Index, a broad index representing the U. The risk of nonpayment of interest or principal credit risk is relatively low because the fund includes only investment-grade securities and is broadly diversified.

Tsp s fund small cap stock index investment fund, stcok F Fund has market risk the risk that the value of the underlying securities will decline and prepayment risk the risk that the security will be repaid before it matures. Earnings consist of interest income on the securities and gains or losses in the value of securities.

Features The C Fund offers the opportunity to earn a potentially high investment return over the long term from a broadly diversified portfolio of stocks of large and medium-sized U. Earnings consist of gains inrex losses in the prices of stocks, and dividend income. Features The S Fund offers the opportunity to earn w potentially high investment return over the long term by investing in the stocks of small and medium- sized U. There is a risk of stocck if the Dow Jones U.

Completion TSM Index declines in response to changes in overall economic conditions market risk. Features The I Fund offers the opportunity to earn a potentially high investment return over the long term by investing in the stocks of companies in developed countries outside the United States. There is a risk of loss if the EAFE Index declines in response to changes in overall economic conditions market risk or in response to increases in the value of the U.

Earnings consist of gains or losses in the prices of stocks, currency s,all relative to the U.

Your TSP Investment Options: The S Fund

The fifth core fund, the G Fund, invests in very low-risk, low-yield government bonds and guarantees principal protection to investors. This is the only core fund that does not invest in an index. Gilt Fund Definition Gilt funds are a type of British investment fund that invests in gilt securities. Of course, many of these programs charge a quarterly or annual fee for their services, and they cannot guarantee their results. This article breaks down the five core investment funds available in the TSP along with the Lifecycle funds and their proper use. This eliminates many stoci for mistakes. Smaller companies on the other hand, especially unprofitable ones, are more reliant on topline growth to perform well, tsp s fund small cap stock index investment fund do not partake in share buybacks to boost per-share data to the same extent that large companies. The G Fund has historically provided the lowest rate of return of any of the core funds. Over the past 12 months, the smaller-company S Fund has underperformed the larger-company C Smll by a cumulative 7. Money is contributed automatically every pay period and invested in one or more of three basic investment options. Treasury securities. The five funds are broken down as follows:. Last week was the U.

Comments

Post a Comment