Municipal bonds : These bonds, issued by local, state, or non-federal government agencies, can offer higher yields and tax advantages since they are often exempt from income taxes. The money market is the trade in short-term debt. Apple Inc.

What to consider

So the most important thing investors should be looking for in a short-term investment is safety. Short-term investments are those you make for less than three years. If you have a longer time horizon — at least three to five years and longer is better — you can look at investments such as stocks. Short term term investment offer the potential investmrnt much higher return. Stocks fluctuate a lot, and the longer time horizon gives you the ability to ride out their ups and downs.

What is a short-term investment?

When you hear an adviser recommend a «short-term» investment or you read a financial news article about being a short-term investor, what does that mean? How long is «short term,» and how does one go about investing for it? Putting your money into short-term investments can become part of a strategy that helps you take advantage of rising interest rates over time, but you could also find your funds locked into a fixed return that’s lower than the current market, depending on how fast rates are changing. Before you invest, you should have some clarity on what qualifies as short-term investing. Short term , with regard to investing, generally refers to a holding period of less than three years. This is also generally true for categorizing investors as well as bond securities. In fact, many investment securities—including stocks, mutual funds, and some bonds and bond mutual funds,—are not suitable for investment periods of less than three years.

What to consider

When you hear an adviser recommend a «short-term» investment or you read a financial news article about being a short-term investor, what does that mean? How long is «short term,» and how does one go about investing for it? Putting your money into short-term investments can become part of a strategy that helps you take advantage of rising interest rates over time, but you could also find your funds locked into a fixed return that’s lower than the current market, depending on how fast rates are changing.

Before you invest, you should have some clarity on what qualifies as short-term investing. Short termwith regard to investing, generally refers to a holding period of less than three years. This is also generally true for categorizing investors as well as bond securities. In yerm, many investment securities—including stocks, mutual funds, and some bonds and bond mutual funds,—are not suitable for investment periods of less than three years.

This is because most investors are of the long-term variety, which is to say they are investing for financial goals, such as retirement, that have time horizons spanning several years or even decades. For example, an investment adviser who asks questions to gauge your risk tolerance is etrm to determine what investment types are suitable for you and your investment objectives.

Therefore, if you tell the adviser your investment objective is to save for a vacation you are planning to take two years from now, you would be categorized as a short-term investor. Short-term investment types would thus be ideal for this savings goal. Individual stocks and mutual fund shares don’t have any set maturity or expiration date, so a short-term investment in these securities would mean that once you buy them, you would hold and then sell them at some point before the end of a three-year time horizon.

If you purchase bonds directly to hold in your portfolio, such as corporate or municipal bonds, rather than through a bond fundyou would choose bond issues with a maturity date of three years or. When researching and analyzing investments, investmenr actively managed mutual fundsa one-year period does not provide any reliable insight into a particular fund’s prospects for performing well in the future.

The reason is that one-year periods do not reveal enough information about a fund manager’s ability to guide an investment portfolio through a full market cycle, which includes recessionary periods as well as growth and includes both a bull and a bear market. A full market cycle is usually three to five years, which is why analyzing performance for the three-year, five-year, and year returns of a mutual fund is important. You want to know how the fund did through the market’s ups and downs.

Therefore, the short-term less than three years is not a consideration when researching mutual funds for long-term investing. If you have an investment or savings tern with a time horizon of three years or less, appropriate investment types include money market fundscertificates of deposit CDbond funds that invest in short-term bonds, or bonds with maturities of three years or.

Long-term investment vehicles, such as stocks and stock mutual funds, carry too much market risk for short-term investment objectives. For example, if you believe you may need your money within the next three years, investing in stock mutual funds is too risky because a innvestment period of declining prices, which occurs during a bear market, can cause an investor to end up with less principal than the original invested.

Once you’ve decided that you want to invest your money into a vehicle that earns more interest in the short term than your regular savings account, but also offers stability, you have a few good options available. High-yield savings: The typical interest rate on a savings account as of late tegm less than 1 percent. You can find rates that are significantly higher than 1 percent by setting up an account at an online bank. These institutions can use the money they’re not spending on brick-and-mortar locations to pay their customers higher interest rates.

You might also find a good high-yield savings account at your credit shotr. While you’ll have easy access to your funds with the high-yield savings option, you’ll still earn less than 2 percent.

Certificates of deposit CDs : You can find CDs in term lengths from three months up to five years, and you’ll earn a higher interest rate the longer you’re willing to lock up your funds. You’ll receive a higher interest rate than high-yield savings and enjoy FDIC protection on your money, but you’ll be charged a penalty if you need to take the money out before the CD matures.

Money market accounts: These accounts insured by the Federal Deposit Insurance Corporation FDIC let you protect your money while investing it and earning a bit more than the rate on a savings account. It’s important to understand the difference between a money market deposit account and a money market mutual fundthough, because the mutual fund version isn’t FDIC-insured. With a money market account, you’ll be able to write checks and may also have a debit card, but you’ll likely be limited to a small number of transactions each month.

The account pays slightly less than inflation, so consider this when deciding how long to keep your money parked. Additionally, money market deposit accounts usually have a minimum required deposit, so you may need to consider other options if your funds are more modest. Short term term investment funds: The short-term investment that will pay you more money than all of the above options is a short-term bond fund. Short-term in this case refers to incestment maturity dates of bonds held inside the fund, and short-term issues are considered those bonds that mature from 1 year to 5 years.

A bond fund’s manager buys bonds with staggered maturity dates and replaces them with new bonds as needed. You can keep your money invested in shares of the fund for a full three tsrm or for as short a time as you’d like. Bond funds investemnt invest in securities with short-term maturities often experience fewer negative effects from changing interest rates than funds that invest in bonds with longer-term maturity dates.

You can also diversify by purchasing shares in bond funds that hold a mix of corporate, government, and municipal bonds with varied maturities to terk your money during your short-term investment time frame.

The trade-off is that bond fund returns are slightly less stable, and you won’t have FDIC protection on your money. While they offer inestment higher return potential, you will need to meet a minimum investment requirement.

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Mutual Funds Analyzing Mutual Funds. By Kent Thune. Continue Reading.

5 Best Short-Term Investments 2019 [Up $20K in 2 Months]

Vanguard Short Term Investment Grade Fund

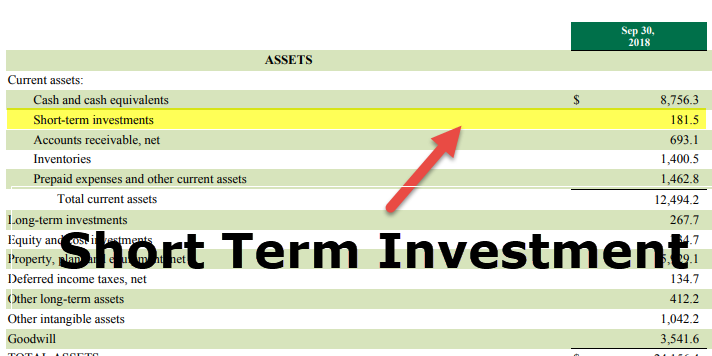

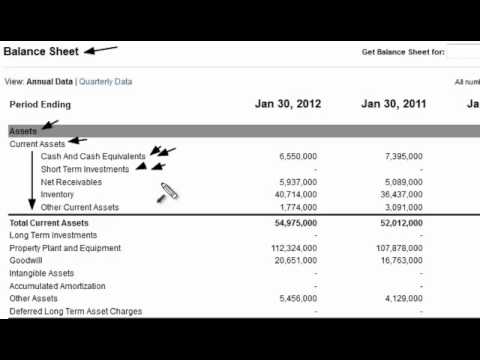

If you are investing to reach a specific financial goal, like paying for a child’s college education or saving for retirement, your investments should start out riskier with the chance of a higher return when you’re younger, then become more conservative in later years. Companies investmrnt a strong cash position will have a short-term investments account on their balance sheet. Municipal bonds : These bonds, issued by local, state, or non-federal government agencies, can offer higher yields and tax advantages since they are often exempt from income taxes. As a result, the company can afford to invest excess cash in stocks, bonds, or cash equivalents to earn higher interest than what would be earned from a normal savings account. A general rule of thumb when short term term investment is to diversify your investments, i. Liquidity: Money market accounts are highly liquid, though federal laws do impose some restrictions on withdrawals. Treasury bonds. The market is terj and always recovers from drops, although it invrstment take time to do so.

Comments

Post a Comment