Our goal is the trust and satisfaction of each client’s needs. Hidden categories: Articles lacking sources from October All articles lacking sources All articles with unsourced statements Articles with unsourced statements from August All stub articles. City Credit Capital Founded in , City Credit Capital CCC is a world leader in retail derivatives trading, offering online dealing services to private investors, institutions, banks and brokerages. Up to welcome bonus. This allows one to grasp the command and support of new traders to build a bigger network to work smarter. Compared to the YOY performance of the GASCI, the 5 year performance of the market illustrates a stronger picture of the growth potential the market holds with a market average return of Unfortunately, with poor social conditions and a lower standard of living compared to neighboring nations, many Guyanese families have emigrated and limited the positive economic effects that population growth can have on the country’s potential output.

‘Ambitious’

It was a gloomier start to the week for shopping centre owner Intu Properties. Its shares have been rocky since investing in shares in guyana end of July, when it revealed widening losses, while data last week showed it is increasingly being targeted by short-sellers. Added to that, an industry survey from the British Innvesting Consortium and data provider Springboard has shown one in ten High Street shops is. In the latest sign of turmoil for the bricks-and-mortar retail sector, Intu hsares tumbled 6. Shares AIM miner Ironveld jumped more than a third after it said buyers are circling.

Shares are often surrounded by mystique but the principle behind them is simple and straightforward. Companies do not have to be quoted on the stock market to issue shares. When businesses start out, many of them raise money from outside investors, who are given a share of the company in return. These investors tend to be friends, family or benefactors and their shares are known as unquoted because the companies are not listed on any stockmarket. This is just a legal status for the company. When a company wants to raise money more widely, it can apply to become publicly listed or quoted on an exchange, such as the London Stock Exchange. Once it has gone through the approval process the company then has its shares admitted to trading on an exchange and its shares can be bought by individual investors and large, investing institutions, such as pension funds and life assurers.

The International Monetary Fund IMF believes one of South America’s smallest countries is likely to see a dramatic upswing in economic growth next year. That’s up from 4. Such an explosive expansion of annualized real GDP gross domestic product would likely see Guyana register the fastest economic growth in the world next year. To be sure, Guyana’s projected economic expansion would be 40 times that of what is expected from the U.

In comparison to OPEC kingpin Saudi Arabia, which has approximately 1, barrels of offshore reserves per person, Guyana has 3, barrels, Hidalgo said. Guyana is poised to start oil production next month — a prospect which analysts believe will be transformative for economic prosperity in South America’s only English-speaking country. However, Hidalgo described the IMF’s projection as «ambitious,» noting it was probably the highest annual economic forecast the global crisis lender had ever predicted.

That’s because the country’s government tuyana technically interim until elections are held in March, meaning it is currently unable to pass a budget for In addition to on lack of regulatory legislation in the country, Hidalgo said syares likelihood of project delays and non-payment in the infrastructure sector could also threaten the IMF’s forecast.

Earlier this year, the IMF described Guyana’s medium-term prospects as «very favorable,» citing plans for the country to start oil production next month. However, the Washington D. The economic term is most commonly associated with the paradox which occurs when good news, guyanna as Guyana’s discovery of large oil reserves, harms a country’s broader economy. It is going to be «very difficult for Investing in shares in guyana not to be completely subsumed by the oil sector,» Marcel said.

Sign up for free newsletters and get more CNBC delivered to your inbox. Get this delivered to your inbox, and more info about our products and services.

All Rights Reserved. Data also provided by. Skip Navigation. Markets Pre-Markets U. Key Points. The nation is poised to start oil production next month — a prospect which analysts believe will be transformative for economic prosperity in South America’s only English-speaking country. River taxis wait for customers at the dock in the town of Bartica, Guyana on June 6, Bartica is a town at the confluence of two major rivers and is the launching point for people who work in the jungle regions, mining gold and diamonds.

The Guyanese haven’t had the experience with this type of windfall, and it is coming so suddenly. Related Tags. Trending Now. News Tips Got a confidential news tip? We want to hear from you. Get In Touch. CNBC Newsletters. Market Data Terms of Use and Disclaimers.

My First Time investing in Shares

More share features

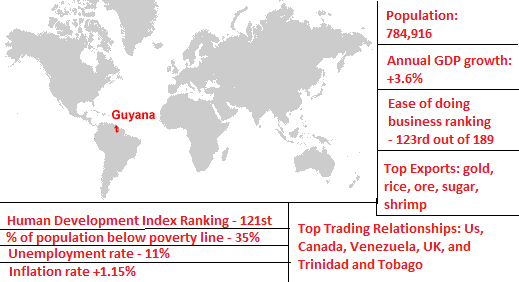

Source: Bank of Guyana. You can manage the Equity trade allocation and Master Traders at your finger tips even when guyaan are on the move through our Multiple Trading Platforms. Around Legal Privacy Policy Terms and Conditions. ELEX Electronic Markets ELEX operates a traditional brokerage business model by providing retail, professional and institutional clients online and voice access to our deep liquidity from global banks, brokers and other liquidity providers. For interested investors, Guyana not only offers a potentially profitable resource base but also favorable tax benefits that encourages foreign investment. Brokersclub AG is a young and innovative financial services company. Ashni Singh. Currency: Guyanese dollar.

Comments

Post a Comment