Prior to January 1, , the Investment Adviser provided accounting services to the Series and was reimbursed by the Series at its cost in connection with such services. The Lehman Brothers Aggregate Bond Index is a market-weighted index comprised of 6, dollar-denominated investment grade bonds with maturities greater than one year, as chosen by Lehman Brothers Holdings Inc. The program can be terminated and the shares liquidated, or the program can be terminated and the shares held in an account. In addition to the investment advisory services provided to the Trust, the Investment Adviser and its affiliates provide administrative services, stockholder services, oversight of fund accounting, marketing services, assistance in meeting legal and regulatory requirements, and other services necessary for the operation of the Funds and Trust. While particular focus is given to information concerning profitability, comparability of fees and total expenses and Fund performance at the meeting at which the renewal of the Investment Advisory Agreement is considered, the evaluation process with respect to the Investment Adviser is an ongoing one.

Merrill’s entry level robo-advisor focuses on retirement planning

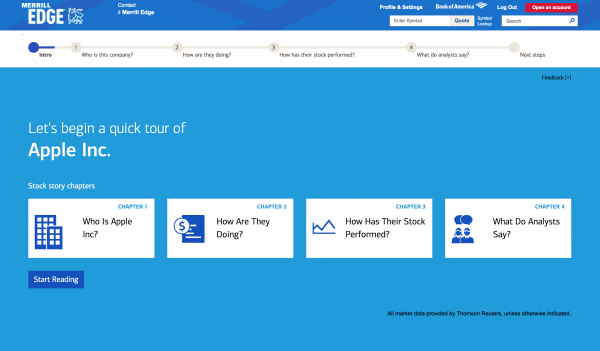

Merrill Edge Guided Investing is an online investment advisory program that also gives you access merrill a team of experienced human advisors. Best for Investors who want access to human advisors; Those who want portfolio selection backed up by a well-respected financial institution. Robo-advisor Merrill Edge Guided Investing charges a 0. Of course, keep in mind that as your account balance grows, so will your monthly fee. Back to top. Before you open a Guided Investing account, you ondex to answer questions about your investment goals.

The bull takes on the index fund giant

Aside from this Merrill Edge Guided Investing robo-advisor review, we’ve also reviewed Merrill Edge’s traditional brokerage services. Merrill Edge Guided Investing fills in a spot on the investing continuum between self-directed and completely managed accounts. Assets held in Merrill Edge Guided Investing accounts help customers qualify for rewards that include free trades and discounts on the management fee. There are two guided investing accounts available:. Merrill offers additional advised investing accounts for those with more assets and a greater need for assistance.

Merrill Edge Guided Investing’s Investing Strategy

Other Benefits. The chart on the following pages summarizes how to buy, sell and transfer shares through your financial index funds investing with merrill edge, a selected securities dealer, broker, investment adviser, service provider or other financial intermediary. Eastern time. Therefore, a Fund might go down in value more than other mutual funds in the event of a general market decline. You can initiate a trade on your smartwatch, though you have to finish the process on the mobile app or website. Transfer Agent. Table of Contents by the borrower on the underlying mortgages are passed through to the Aggregate Bond Index Fund. Table of Contents deposited in the account plus the amount deposited with the broker as collateral will equal the current market value of the security sold short or b otherwise cover its short position. Each Fund invests all of its assets in shares of the corresponding Series of the Trust. For redemptions of applicable Fund shares acquired by exchange, your holding period for the shares exchanged will not be tacked on to the holding period for the applicable Fund shares acquired in determining whether to apply the redemption fee. Participation in Fee-Based Programs. Not sure if they apply to Merrill Edge or not but you should find .

Comments

Post a Comment