Hari will get Rs. Richter M. Decision analysis involves much more than computing the expected utility of each alternative. In such a case, the decision-maker may buy the expert’s relevant knowledge in order to make a better decision. However, the manager is hesitant about this decision.

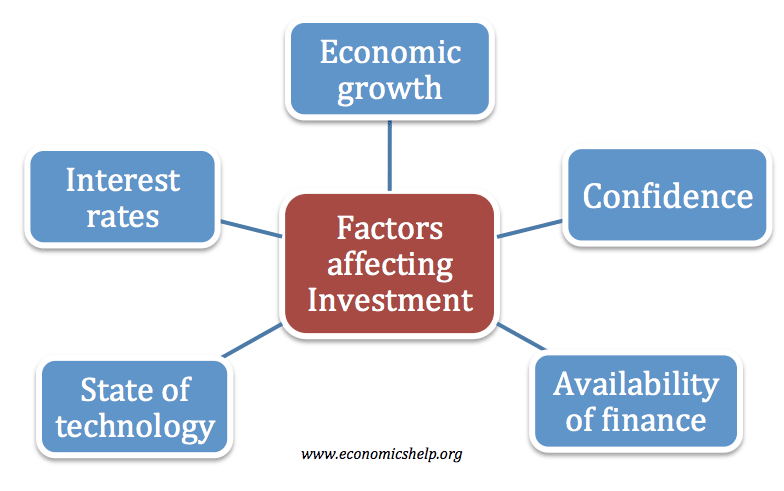

Read this article to learn about the decision types, decision framework and decision criteria of statistical decision theory! Every individual has to make some decisions or state of nature investment decision problem regarding his every day activity. The decisions of routine nature do not involve high risks and are consequently trivial in nature. Such decisions which affect other people in society involve a very careful and objective analysis of their consequences. He puts in an effort to detect if there is a behaviour pattern which is relevant to a particular decision process and whether it is consistent enough to be expressed in the form of a rule. The best way of finding out if there is any consistency is by fixing certain standards forejudging a particular situation. These standards are fixed, based on past experiences or on the knowledge about past events.

In computability theory and computational complexity theory , a decision problem is a problem that can be posed as a yes-no question of the input values. An example of a decision problem is deciding whether a given natural number is prime. Another is the problem «given two numbers x and y , does x evenly divide y? The answer is either ‘yes’ or ‘no’ depending upon the values of x and y. A method for solving a decision problem, given in the form of an algorithm , is called a decision procedure for that problem. A decision procedure for the decision problem «given two numbers x and y , does x evenly divide y?

Read this article to learn about the decision types, decision framework and decision criteria of statistical decision theory! Every individual has to make some decisions or others regarding his every day activity. The ibvestment of routine nature do not involve high risks and are consequently trivial in nature. Such decisions which affect other people in society involve a very careful and objective analysis of their consequences.

He puts in an effort to detect if there onvestment a behaviour pattern which is relevant to a particular decision process and whether it is consistent enough to be expressed in the form of a rule. The best way of finding out if there is any consistency is by fixing certain standards forejudging a particular situation.

These standards are fixed, based on past experiences or on the knowledge about past events. The business decision maker can make his work easier with the assistance of some standards and tools. There are a few problems where the decision maker gets almost complete information so that he knows all the facts about the state of nature and again which state of nature would occur and also the consequences of the state of nature. In such a situation, the problem of decision making is simple because the decision maker has only to choose the strategy which will give him maximum pay-off in terms of utility.

A problem of this kind arises when the state investmfnt nature is unknown, but based on the objective or empirical evidence, we can possibly assign probabilities to various states of nature.

In a number of problems on the basis of historical data and past experience, we are able to assign probabilities to various states of nature. In such cases, the pay-off matrix is of immense help for reaching an optimal decision by assigning probabilities to various states of nature. The process of making decision under conditions of uncertainty takes place when there is hardly any knowledge about states of nature and no objective information about their probabilities of occurrence.

In such cases of absence of historical data and relative frequency, the probability of the occurrence of the particular state of nature cannot be indicated. Such situations arise when a new product is introduced or a new plant is set up. Of course, even in such cases some market surveys are conducted and relevant information is gathered though it is not generally sufficient to indicate a probability figure for the occurrence of a particular state of nature.

This type of situation is somewhere between the conditions of risk and conditions of uncertainty. As regards conditions of risk, we have seen that the probability of the occurrence of various states of inestment are known as the basis of past experience, and in conditions of uncertainty, there is no such data available.

But many situations arise where there is partial availability of data. In such circumstances, we can say that decision making is done on the basis of partial information. A condition of conflict is supposed to occur when we are dealing with rational opponent rather than the state of nature. The decision maker, therefore, has to choose a strategy taking into consideration the action or counter-action of his opponent.

The strategy choice is done as the basis naturw game theory where a decision maker anticipates the action of the opponent and then determines his own strategy.

It includes identification of the problem. Personal perception and innovativeness are two essential things for the identification invesgment the problem, and then generating alternative course of action and finally evolving criteria for evaluating the different alternatives to arrive at the best choice of action.

There are many alternative courses of action in any decision problem. But only some relevant alternatives need be considered. For instance, the business firm may decide to market its goods within the state or within the country or beyond the boundaries of the country. Here, there are three alternatives. There may be more such alternatives. There are those possible events or the states of nature which are uncertain but are vital for the choice of any one of the alternative acts. For example, the radio dealer does not know how many radios he will be able to sell.

There is an element of uncertainty about it and for this reason he cannot decide how many radios to buy. This uncertainty is known naturr the state invfstment nature or the state of the world.

There is an outcome of the combination of each of the likely acts and possible states of nature. This is otherwise known as conditional value. The outcome has not much significant unless we calculate the pay-offs in terms of monetary gain or loss for each outcome. Thus outcome refers state of nature investment decision problem the result of ivestment combination of an act and each of the states of nature.

The pay-off deals with the monetary gain or loss from each of the outcomes. Therefore where the value of output is expressed directly in terms of gain expressed in money it is called pay-off. The calculation of pay-off or utility of each outcome has to be carefully.

In practical business situation, there is risk and uncertainty. In the case of risk, the probability of each state of nature is known, and in uncertainty, it is unknown. Where P 1 to P n refers to event probabilities of events E 1 to E n and O ijthe pay-offs of the outcome with the combination of each event and act. The expected value of each alternative is thus calculated with reference to probability assigned to each state of nature.

The nature of the decision criteria would depend upon the type of the decision situation as follows:. Under this condition; there is one pay-off for each strategy. The pay-off represents the degree of achievements of the objective, hence the largest pay-off is chosen and the corresponding strategy is selected. Under condition of risk, there would be more than one state of nature but the probabilities of their occurrence are known on the basis of past experience.

The strategy which gives the maximum pay-off is selected. Under conditions knvestment uncertainty, we do not have a set of probabilities for the state of nature. Therefore, for each alternative only pay-offs or utilities are known. But nothing is known about the likelihood of each state of nature. The problem becomes more complex and the personality of the decision maker plays an important role in the selection of the problfm.

The strategy which gives the highest minimum pay-off will be chosen. The basic rationale behind this criterion is that pessimism is not irrational under the state of uncertainty.

The idea is to avoid the worst. In this criterion the motive of self preservation is considered. If the decision maker is an optimist by nature, he would always think that the state of nature would be the best from his point of view. He will find out the expected pay-off of all the strategies and pick up the strategy which gives the maximum pay-off out of all the strategies. He will always think that the state of nature would be favourable. The regrets have to be calculated for each act with reference to the best pay-off of the various alternative acts.

After this, the strategy which maximises the expected pay-off inestment chosen. You must be logged in to post a comment. Leave a Reply Click here to cancel reply.

Decision Analysis 1: Maximax, Maximin, Minimax Regret

Richter M. Similar analysis should be conducted to construct the remaining columns of the reliability matrix. The word statistics is not derived from any classical Greek or Latin roots, but from the Italian word for state. Coefficient of Variation as Risk Measuring Tool and Decision Procedure: Based on the above decision, and its decision-tree, one might develop a coefficient of variation State of nature investment decision problem. Optimists are right; so are the pessimists. The tree in panel a considers monetary gain and loss; the tree in panel b shows utility gain and loss.

Comments

Post a Comment