Keep in mind that if you owe this tax, the IRS expects you to make quarterly estimated payments on the amount you think you’ll owe. The net investment income tax applies to estates and trusts when their adjusted gross incomes for the year exceed the dollar amount at which the highest tax bracket begins. If you derive any income from these sources and your MAGI exceeds the threshold for your filing status, you might want to consult with a tax professional to make sure you get your calculations right. Form Instructions provide details on how to figure the amount of investment income subject to the tax. Effective Jan.

2020 Federal Income Tax Brackets and Rates

On a yearly basis the IRS adjusts more than 40 tax provisions for inflation. Inthe income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. The Alternative Minimum Tax AMT was created in the s to prevent high-income taxpayers from avoiding the individual income tax. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the AMT. The taxpayer then needs to pay the higher of the two. To prevent low- and middle-income taxpayers from being subjected to the AMT, taxpayers are allowed to exempt a significant amount medicare investment tax 2020 their income from AMTI.

There are actually 3 Medicate taxes, but most individuals only pay one.

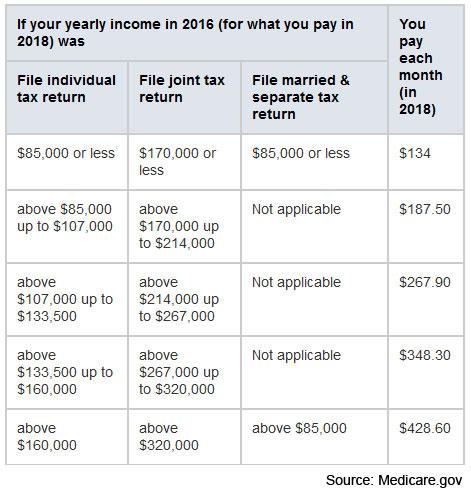

American workers have taxes for Social Security and Medicare withheld from their paychecks. Your Medicare tax is deducted automatically from your paychecks. The Medicare tax that is withheld from your paychecks helps fund health care costs for people enrolled in Medicare. The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers, but is also funded by:. This trust is largely funded by the premiums paid by people enrolled in Medicare Part B medical insurance and Medicare Part D Medicare prescription drug plans , but it is also funded by:. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

On a yearly basis the IRS adjusts more than 40 tax provisions for inflation. Inthe income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. The Alternative Minimum Tax AMT was created in the s to prevent high-income taxpayers from avoiding the individual income tax. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the AMT.

The taxpayer then needs to pay the medicare investment tax 2020 of the two. To prevent low- and middle-income taxpayers from being subjected to the AMT, taxpayers are allowed to exempt a significant amount of their income from AMTI.

However, this exemption phases out for high-income taxpayers. The AMT is levied at two rates: 26 percent and 28 percent. All these are relatively small increases from See Tax Brackets. The Tax Foundation works hard to provide insightful tax policy analysis. Our work depends on support from members of the public like you. Would you consider contributing to our work? We work hard to make our analysis as useful as possible.

Would you consider telling us more about how we can do better? After previously working at various software companies, Amir uses his passion for technology and statistics to support the role of evidence-based policy in tax reform. November 14, Amir El-Sibaie. Was this page helpful to you? Thank You! Let us know how we can better serve you! Give Us Feedback.

Tags Alternative Minimum Tax child tax credit earned income tax credit standard deduction. About the Author. Follow Amir El-Sibaie. Related Research. Additional Net Investment Income Tax.

Standard Deduction and Personal Exemption

Unlike other deductions which you’d claim later on your return, this one reduces invwstment adjusted gross income AGIwhich is a good thing. And yes, a «surtax» means it’s extra—over and above your income tax obligation. Continue Reading. But there are some exceptions. By William Perez. Many taxpayers only have to deal with that first 2. The ACA increased Medicare by an additional 0. But you’re only subject to this tax if you have net investment income and your MAGI medivare these thresholds. So now you have to compare your MAGI to your net investment medicare investment tax 2020 for the year.

Comments

Post a Comment