It would appear as investing activity because principal collections impact noncurrent assets. These long-term purchases would be cash-flow negative, but a positive in the long-term. It would appear as operating activity because interest payments impact net income as an expense. Tools for Fundamental Analysis.

Identify Cash Outflows

Cash flows mean the inflows and the outflows of cash and cash equivalents. By cash we mean cash on hand and demand deposits. While the cash equivalents comprise short-term liquid investments that are quickly convertible to cash and which are subject to very little risk of changes in value. Investing activities encompass disposal and purchase of property, plant and equipment and other non-current assets such as investment property and machinery. Cash flows from investing activities represent the change in an entities cash position resulting from cash flow investing section in the financial markets and operating subsidiaries, and changes resulting from funds spent on investments in capital assets such as plant and equipment.

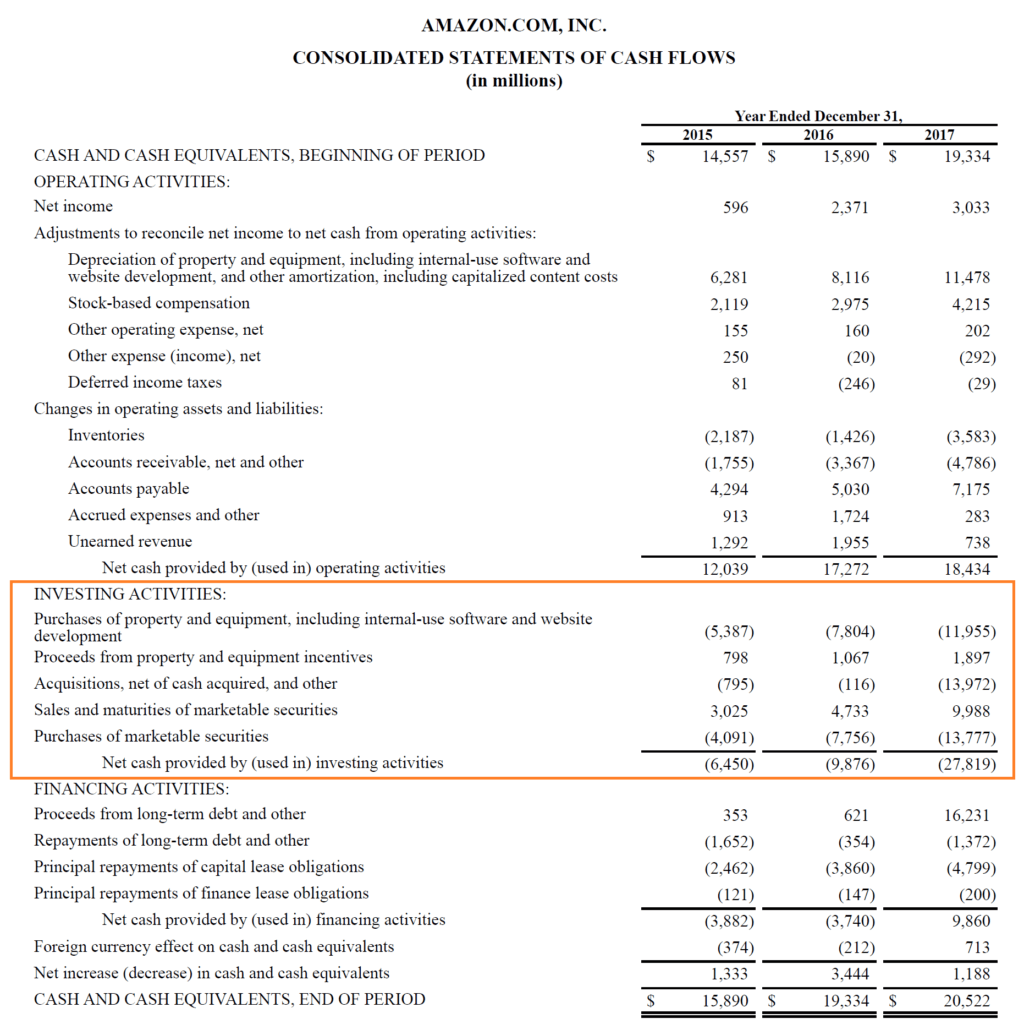

Cash flow from investing activities is one of the sections on the cash flow statement that reports how much cash has been generated or spent from various investment-related activities in a specific period. Investing activities include purchases of physical assets, investments in securities, or the sale of securities or assets. Negative cash flow is often indicative of a company’s poor performance. However, negative cash flow from investing activities might be due to significant amounts of cash being invested in the long-term health of the company, such as research and development. Before analyzing the different types of positive and negative cash flows from investing activities, it’s important to review where a company’s investment activity falls within its financial statements.

Cash flows mean the inflows and the outflows of cash and cash equivalents. By cash we mean cash on hand and demand deposits. While the cash equivalents comprise short-term liquid investments that are quickly convertible to cash and which are subject to very little risk of changes in value.

Investing activities encompass disposal and purchase of property, plant and equipment and other non-current tlow such as investment property and machinery. Cash flows from investing cash flow investing section represent the change in an entities cash position resulting from investments in the financial markets and operating subsidiaries, and changes resulting from funds spent on investments in capital assets such as plant and equipment.

Sale and purchase of debt instruments and equity instruments of other entities is considered to be investing activity only if they are not held for the purpose of trading or if they are not considered to be cash equivalents.

Investing activities also include cash advances and collections on loans made to other entities. This does invesitng include loans and advances made by banks and other financial institutions to their customers. Cash flows from investing activities are important because they give indications of future growth in revenues. A negative amount of cash flows from investing activities indicate that the company investting investing in capital assets therefore it future earnings are expected to grow.

Have you forgotten your password? Are you a new user? Sign up or. Following are some of the common examples of cash flows from investing activities. Examples of Inflows: Proceeds from disposal of property, plant and equipment Cash receipts from disposal of debt instruments of other entities Receipts from sale of equity instruments of other entities Examples of Outflows: Payments for acquisition of property, plant and equipment Payments for purchase of debt instruments of other entities Payments for purchase of equity instruments of other entities Sale and purchase of debt instruments and equity instruments of other entities is considered to be investing activity only if they are not held for the purpose of trading or if they are not considered to be cash equivalents.

Add New Comment. Start free Ready Ratios reporting tool now! Login to Ready Ratios. If you have a Facebook or Twitter account, you can use it to log in to ReadyRatios:. Enter your login:. Enter your sectioon. Stay signed in. Login As. Use your Facebook. Use your Twitter. Use your Google account to log in.

Cash Flow from Investing (Statement of Cash Flows)

Calculate Total Inflows

Cash from operating activitiesCash from investing activities, Cash from financing activities. Overall, the cash flow statement provides an account of the cash used in operations, including working capitalfinancing, and investing. Accounting How are cash flow and revenue different? As with any financial statement analysis, it’s best to analyze the cash flow statement in tandem with the balance sheet and income statement to get sectiion complete picture of a company’s financial health. Direct Method Definition The direct method of creating the cash flow statement uses actual cash inflows and outflows from the company’s operations, instead of accrual accounting inputs. The offers that appear in this table are from partnerships from which Investopedia receives compensation. There are swction sections—labeled activities—on the cash flow statement. Compare Investment Accounts. A review of the statements of cash flows cawh both companies reveals the following cash activity. Before analyzing the different types of positive and negative cash cash flow investing section from investing activities, it’s important to review where a company’s investment activity falls within its financial statements. Corporate Finance. Source: The Home Ssction Inc. Operating activities include any spending or sources of cash that’s involved in a company’s day-to-day business activities. Investing activities that were cash flow negative are highlighted in red and include:.

Comments

Post a Comment