Finance and Banking. Luxembourg-resident individual or corporate investors have to declare their income in their annual tax return. Such withholding tax should be final for a non-resident director provided that the director fees do not exceed EUR , per year and constitute the only Luxembourg professional source income. All Regions. Related Articles.

Luxembourg: Alternative Investment Funds 2019

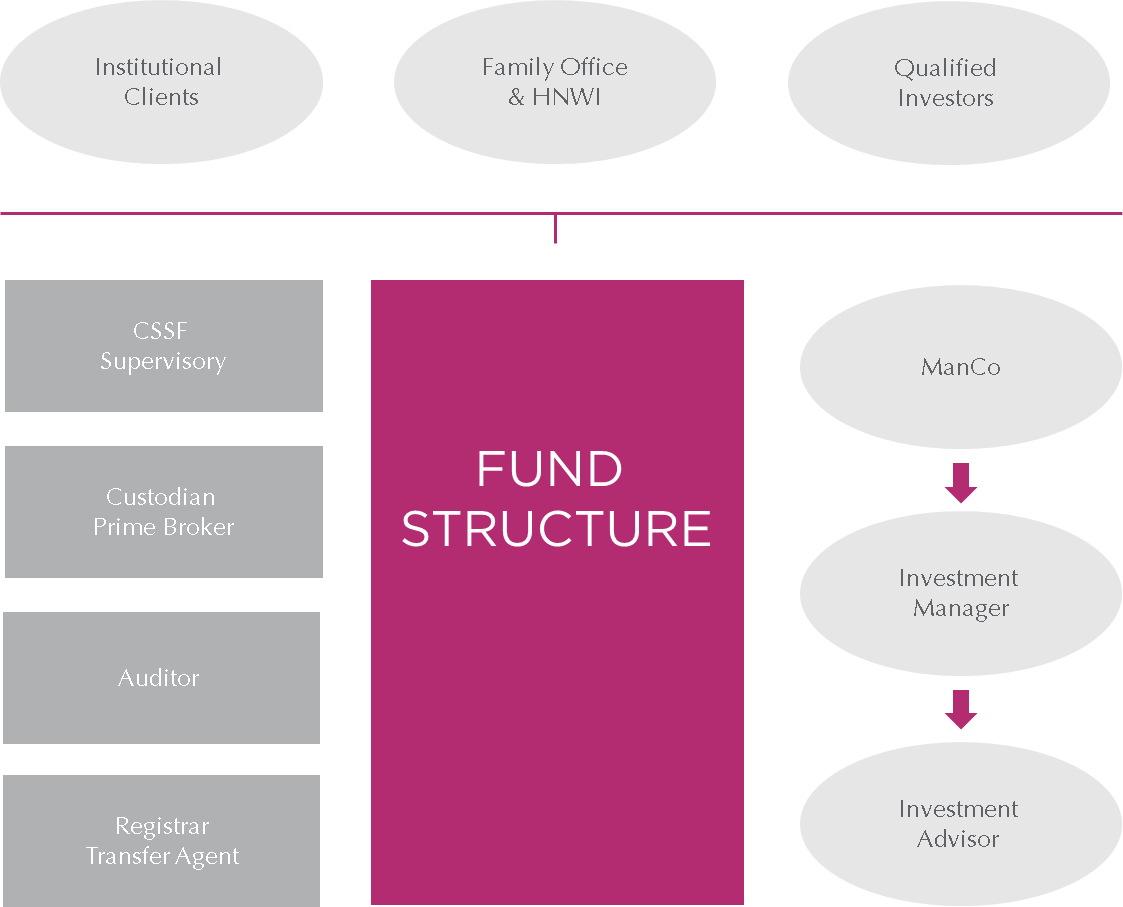

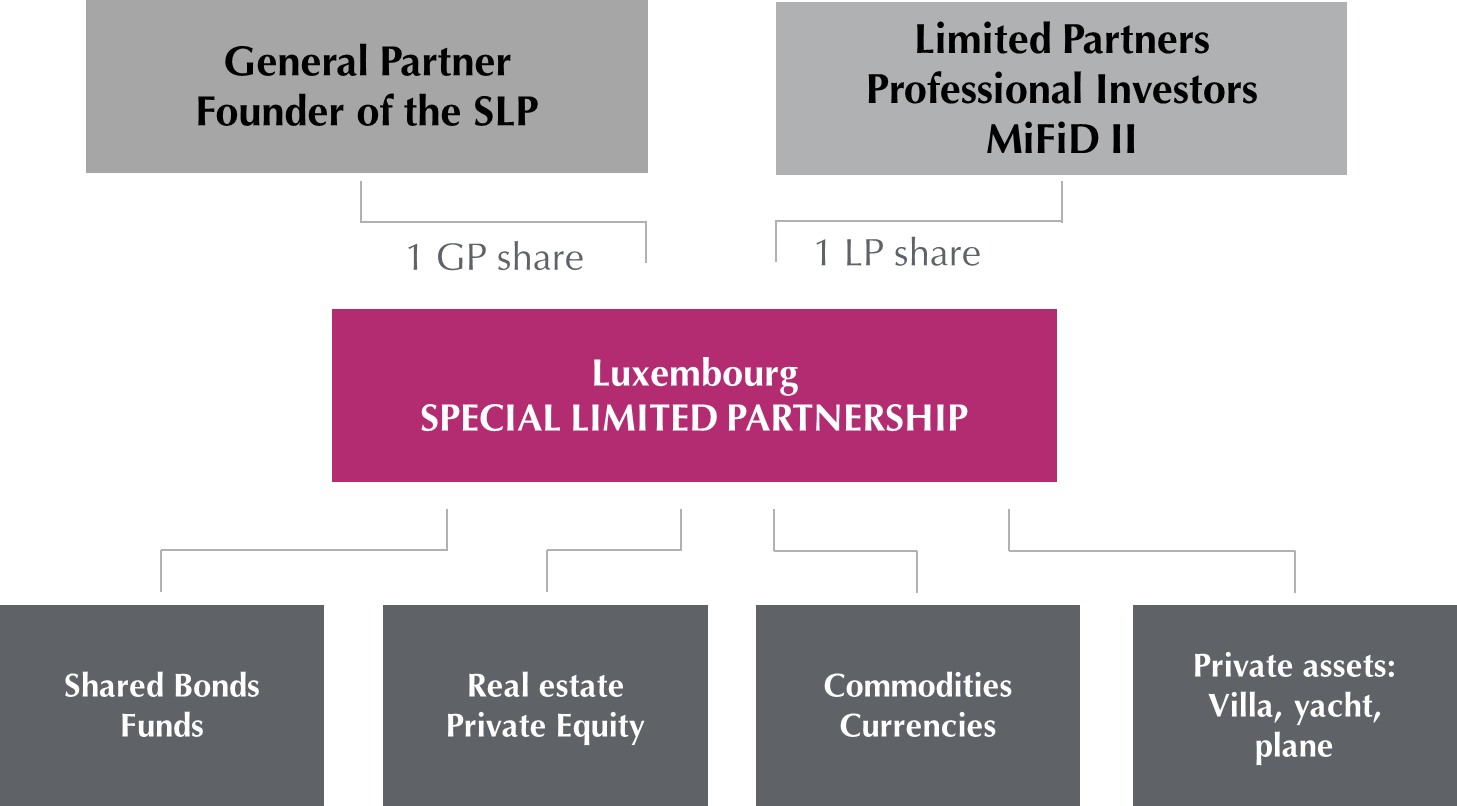

Rechercher :. Investment fund managers turn to Creatrust to make their strategy accessible to relevant audiences. Creatrust establishes and administers unregulated, regulated and private investment vehicles including:. Crypto strategies can also be structured into alternative investments vehicles. Co-investors pool efforts to support the same investment ideas.

Luxembourg Investment Vehicles

The AIFM will be subject to either the simplified registration regime or the full-scope authorisation regime, depending on i the assets under management, and ii whether the AIFM will market the shares on a cross-border basis to investors located outside Luxembourg. Securitisation vehicles, which are governed by the Luxembourg law of 22 March on securitisation vehicles, as amended, should normally be out of the scope of the AIFM Law unless given its features it would fall within its scope. Investment managers managing the portfolio of an AIF may be located abroad. If unknown to the CSSF but supervised by a recognised financial supervisory authority, the CSSF will proceed to a due diligence on available information. If the manager is unregulated, the CSSF will carry out a due diligence on its expertise, track record, financial standing and reputation.

Luxembourg: Alternative Investment Funds 2019

Rechercher :. Investment fund managers turn to Creatrust to make their strategy accessible to relevant audiences. Creatrust establishes and administers unregulated, regulated and private investment vehicles including:. Crypto strategies can also be structured into alternative investments vehicles.

Co-investors luxembourg investment fund vehicles efforts to support the same investment ideas. Capital raising: A great investment idea often requires external finance to succeed. What makes us different is:. Our Funds team acts as a one-stop-shop to take a fund from initial concept through to inception and.

Hedge Funds. Specialised Investment Fund. Real Estate Fund. Private Equity Fund. Investment Fund. Family Office. Creatrust is a member of Allinial Globalan association of legally independent accounting and consulting firms. By sector. Corporate Clients. Fund Platform. About us. Investment Funds Creatrust advises Alternative Investment Fund Managers and fund promoters on how to structure their investment portfolios.

Creatrust offers a one-stop-shop solution that turns an initial investment idea into a successful fund. Fund Promoters. Latest news Bond Listing Markets in Luxembourg. Luxembourg versus Cayman. Redomiciliation in Luxembourg. Contact us Corporate. Newsletter Investment Fund.

Investment Funds in Luxembourg

You will not receive KPMG subscription luxembourg investment fund vehicles until you agree to the new policy. The Council of the European Union on 13 March reached political agreement on a Council Directive introducing mandatory disclosure rules for luxsmbourg such as lawyers, accountants and tax advisers. Czech Republic. Any other publication must be made in compliance with the offering document. Taxation Get an overview about taxation of the different investment vehicles. Hogan Lovells. Specialist advice should be sought about your specific circumstances. Please take a moment to review these changes. The use of nominees who act as intermediaries between investors and the AIF is possible.

Comments

Post a Comment